Why track Gen AI spending

The interest and investment in Generative AI are reminiscent of past investor euphoria. High optimism, a significant number of new companies, and high investment levels, are defining elements of how tech innovation is commercialized. Entrepreneurs and investors see the future, but need to time it effectively with market adoption.

Generative AI spend layers:

Infrastructure - chips and components

Platforms - Azure, GCP, AWS, etc

Models - OpenAI, Anthropic, Cohere

LLM Dev tools - Guardrails.ai, Weights & Biases, Pinecone, etc

Application layers - Midjourney, ChatGPT+, GitHub Copilot, others

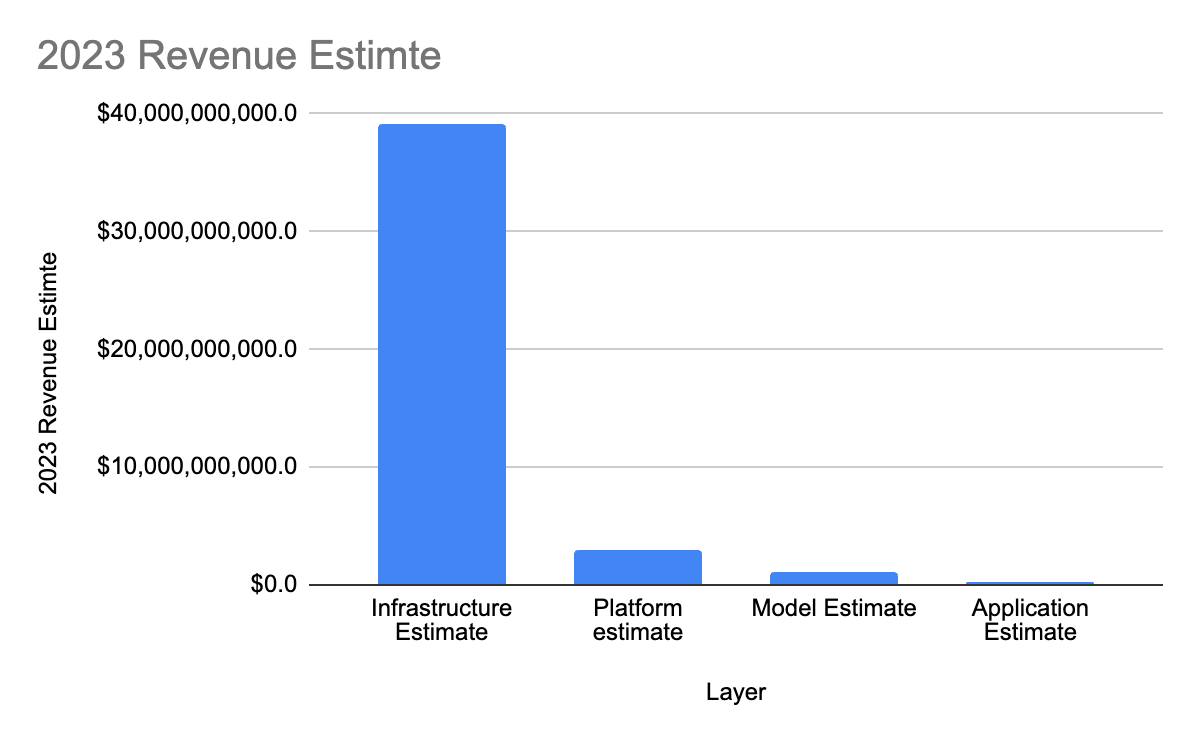

2023 Revenue Estimate

A starting investigation shows the vast majority of the spend is in the infrastructure layer. In particular, NVIDIA’s datacenter revenue segment.

This is an underestimates every section. This is missing key companies and doesn’t reflect how incumbent applications are adopting Gen Ai. Specifically, internal use cases that drive sales cycle efficiency, and incorporating Gen AI into customer products, driving up ACV.

ServiceNow and AppFolio incorporate Gen AI directly into products

For example, ServiceNow reported, “the largest net new ACV contribution” thanks to Gen AI1. AppFolio, introduced Generative AI into it’s property management software with Realm-X. Now “93% of [their customers] use one or more AI-enabled features”.2

$50B invested into Gen AI in 2023

Tracking where revenue is generated in Generative AI helps us understand adoption and potential investor returns. In 2023, PitchNook says there was nearly $50B3 invested into Generative AI.

The money being spent on generative AI roughly equals the money invested into generative AI4. I would have expected investment to exceed revenue, particularly in the first few years.

Open Source Tracking

I’m happy to open source tracking AI spend. If interested, please comment or reach out.

https://tomtunguz.com/now-earnings/

https://finance.yahoo.com/news/q4-2023-appfolio-inc-earnings-110031542.html

This includes investments from corporate venture capital that might come in the form of “GPU credits” as opposed to cash.

Again, GPU credits and revenue attribution are important to acknowledge here. I dont know the best way to get at it.