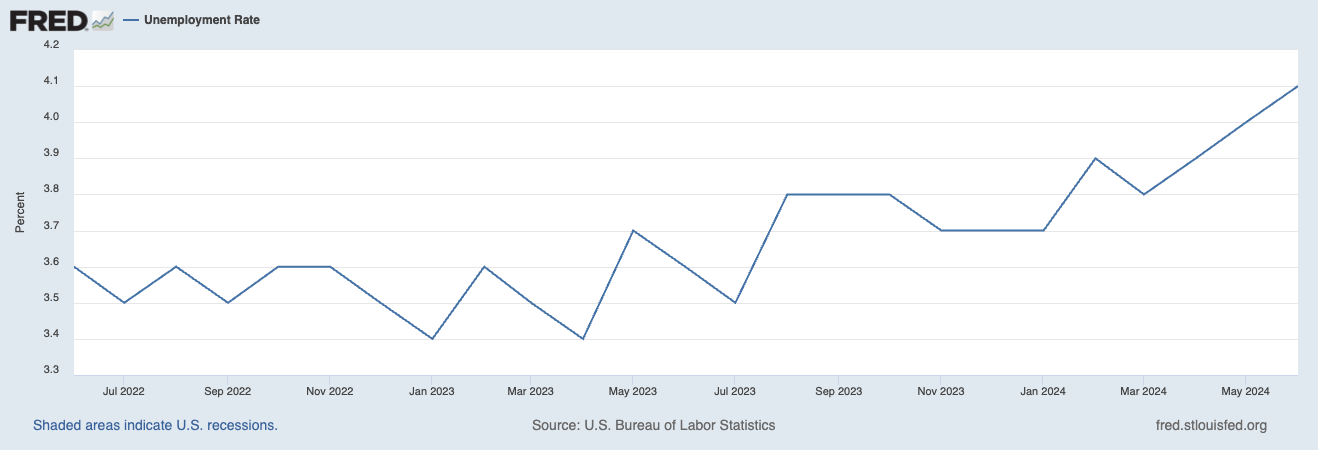

NVIDIA is 16% off its all time high. Commentators speculate we’re seeing a shift out of the MAG 7 into small caps1. A number of staffing and placement, including Robert Half (-10.5% YoY2) & Randstad (-7% YoY3), reported revenue declines, as US unemployment ticked up another 10 basis points to 4.1% from 4%. But, there are areas where companies are continuing to invest.

Artificial intelligence and the capital expenditures to support it are an obvious place of investments. Hyperscalers are allegedly going to invest over $100B4 in building out data centers, GPUs, and models. This post is not about that. Instead, it’s about physical automation.

Robot stocks are doing well, as Andra Keay, from Robots & Startups notes:

Serve, Intuitive Surgical and iRobot are all having stock price surges. It helps if NVIDIA reveals a stake in your company, but some robotics stocks have always been a good return on investment (Intuitive). What a shame I sold my iRobot stock years ago!5

Of the ~42 stocks I track related to robotics, the average performance for the past month is up close to 7% — that is excluding serve robotics. MAGS, an ETF tracking the magnificent 7, is down 6%6 at the same time period.

Driving that performance is continued investment into robotics and automation. That investment spans healthcare ($ISRG), grocery fulfillment centers ($OCDDY), to safety inspection drones ($OII).

Intuitive Surgical, maker of Da Vinci surgical robots, reported revenue growth of 14.5%, and strong adoption of Da Vinci 5, a system that received FDA approval back in March. Intuitive Surgical placed 341 systems, of which 70 were Da Vinci 5.

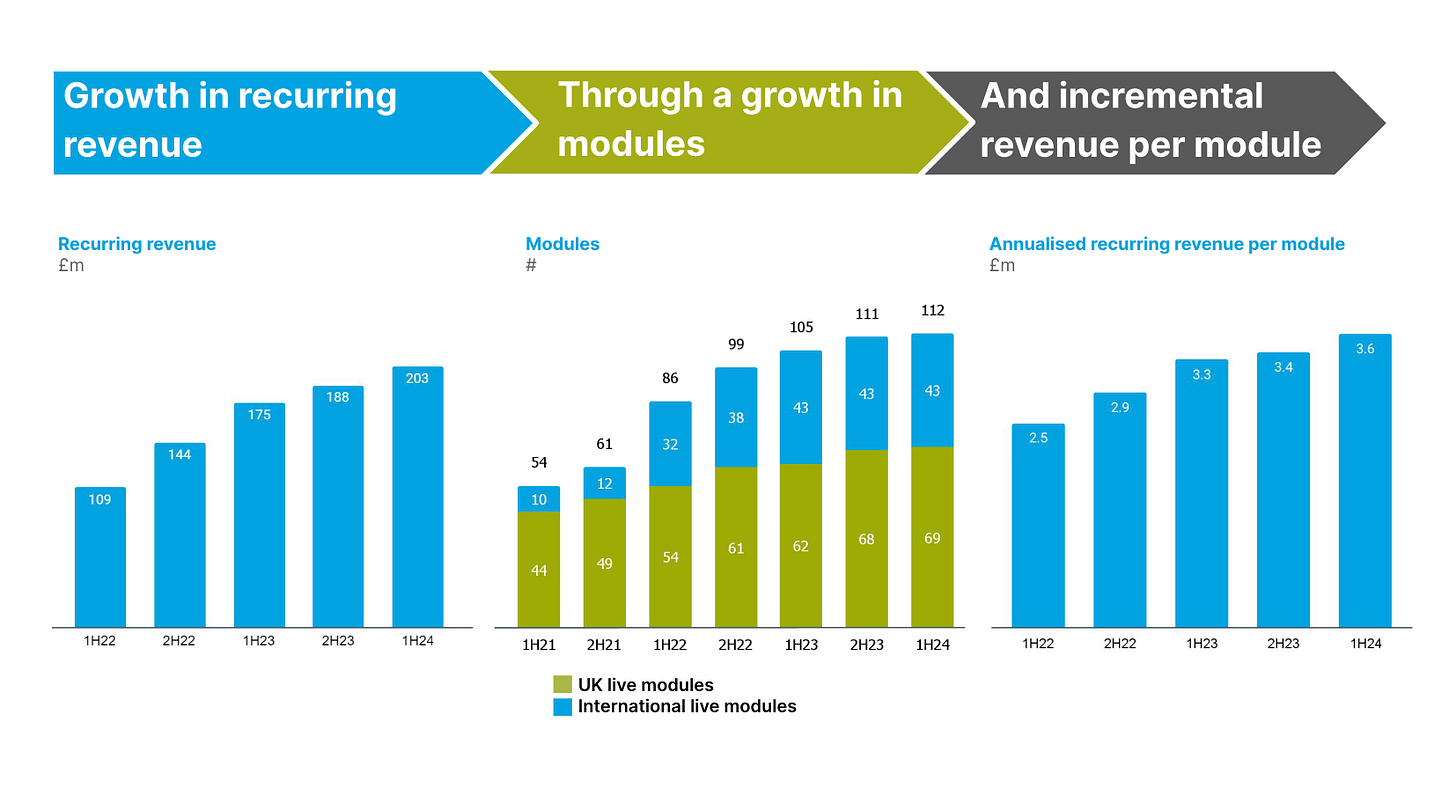

Ocado Group, a British online grocery retailer and seller of Automated Storage Automated Retrieval (ASRS) robots for grocery, reported 22% year-on-year revenue growth of its technology (robotics) division. Ocado has a diversified, global customer base (setting it apart from Symbotic). Ocado is looking to add new product lines beyond perishables into warehouse offerings (an increasingly competitive space).

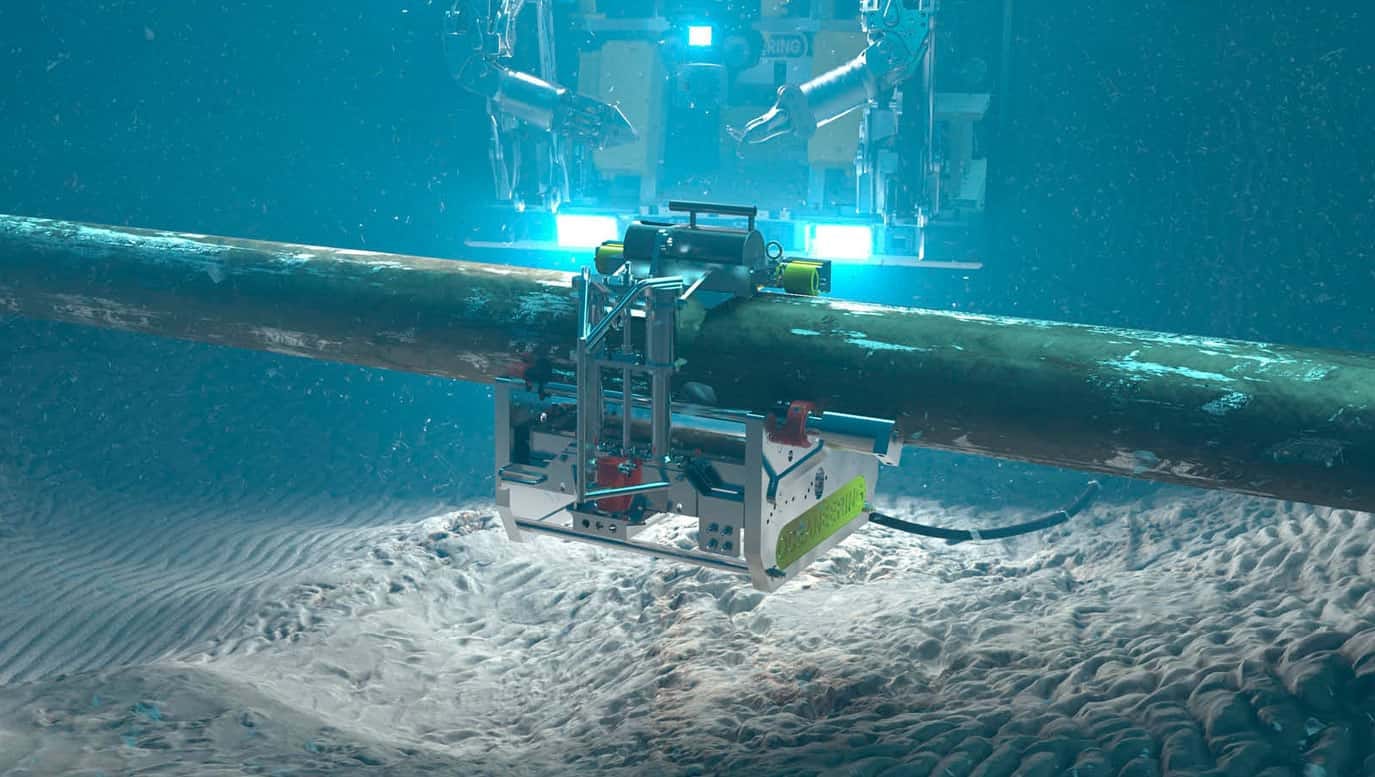

Oceaneering International, which offers underwater inspection drones, has also seen revenue growth. OII provides remotely operated underwater vehicles that can be used for inspection. Potentially useful as the geopolitical environment heats up.

Outside of the public markets, Agility robotics CEO, Peggy Johnson, did an interview on The Robot Report about Digit, a humanoid robot that’s being put to work. Digit has been running a proof of concept with Amazon7, and now with GXO Logistics8. The operational cost per hour is $309, coming in line with the fully loaded cost of a warehouse worker in some states.

While GPUs and humanoid robotics are sucking up a lot of press, a number of publicly traded robotics companies are continuing to grow and get results.

https://www.bloomberg.com/news/articles/2024-07-16/riskiest-stocks-begin-an-epic-rotation-with-rate-cuts-in-sight

$RHI, FY Q2 2024 earnings report

$RANJF, FY Q4 2024 earnings report

https://www.google.com/finance/quote/MAGS:NASDAQ?sa=X&sqi=2&ved=2ahUKEwjS0aDC5sqHAxVd5MkDHVXpDGMQ3ecFegQINBAf&window=5D

https://www.aboutamazon.com/news/operations/amazon-introduces-new-robotics-solutions

https://gxo.com/news_article/gxo-conducting-industry-leading-pilot-of-human-centric-robot/

https://www.therobotreport.com/agility-robotics-digit-humanoid-lands-first-official-job/