Gen AI Apps coming customer acquisition scaling wall

Why it will be harder for Gen AI apps to get distribution than previous cycles, and where to look instead

Generative AI (Gen AI) apps are hitting traction milestones faster than previous startup waves. A number of these apps will hit an unexpected scaling wall (and not the Gen AI data kind). Unlike past technology cycles—Web 2.0, and mobile—Gen AI lacks a native, scalable distribution channel. This is reminiscent of the Web before the rise of Google and SEO. Without a new scalable, distribution channel, Gen AI startups will need to compete against incumbents, in channels where incumbents have a strong advantage.

Previous startup waves had compounding channel growth

In previous technology cycles, startups leverage new distribution channels AND the growth of those channels. This “doubling compounding” —where both the startups and the platforms supporting them expanded simultaneously—was accelerated success

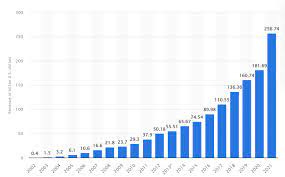

Search and SEO: Startups like LinkedIn and Yelp thrived during the rise of search engines, leveraging SEO at a time when search usage itself was growing exponentially.

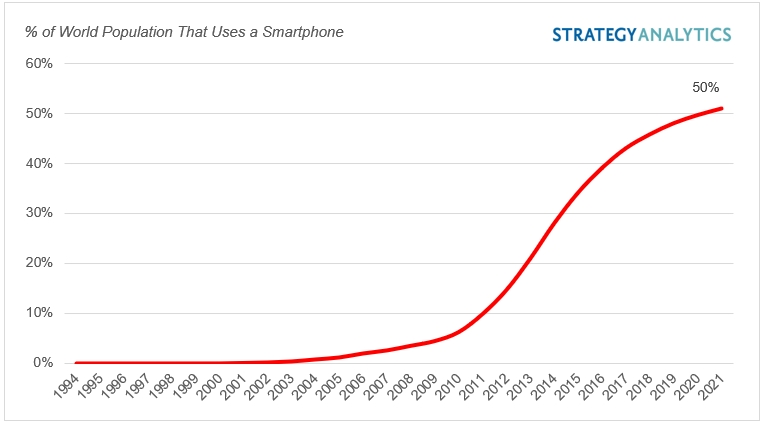

Mobile and App Stores: The mass adoption of smartphones coincided with the rise of app stores as discovery engines. Startups like Instagram and WhatsApp scaled rapidly because app stores were actively growing and introducing millions of new users to apps.

Email for B2B: In the early days of SaaS, email was a rapidly growing communication channel, making email campaigns and SDR outreach highly effective. Professionals were adopting email in droves, and startups capitalized on this ubiquity.

Social Media for Content Distribution: Platforms like Facebook and Twitter prioritized link distribution and traffic growth during their early phases, benefiting content creators and businesses that leveraged them for visibility.

TV for Consumer Brands: Decades earlier, consumer brands like Procter & Gamble succeeded on television, which itself was rapidly gaining new audiences.

Retail for Software: In the 1980s and 1990s, software companies scaled through computer stores, which were flourishing alongside the growth of personal computer adoption.

Startups benefited from both the effectiveness and the rapid expansion of these channels. The channels themselves were tailwinds that amplified startup growth.

There is no Gen AI native, compounding channel (yet)

For Gen AI startups, the landscape is fundamentally different. The channels available today are mature or even contracting, with limited growth and increasing friction:

SEO continues to go away

People in the SEO industry have talked about ‘zero-click searches’ (searches that don’t result in a click to a website) for years. This has been driven by vertical search experiences, e.g., Google Flights, an increase in ad load to drive monetization, and generated snippets. Google’s AIOverviews make this event worse. At its most recent earnings call, Chegg announced that it saw a 37% year-on-year decline after Google rolled out AI Overviews. 1

Previous strategies of writing SEO content, targeting informational queries, see less and less impact. Not only that, but creating this content, actually feeds the answer machines so users don’t need to come to your website.

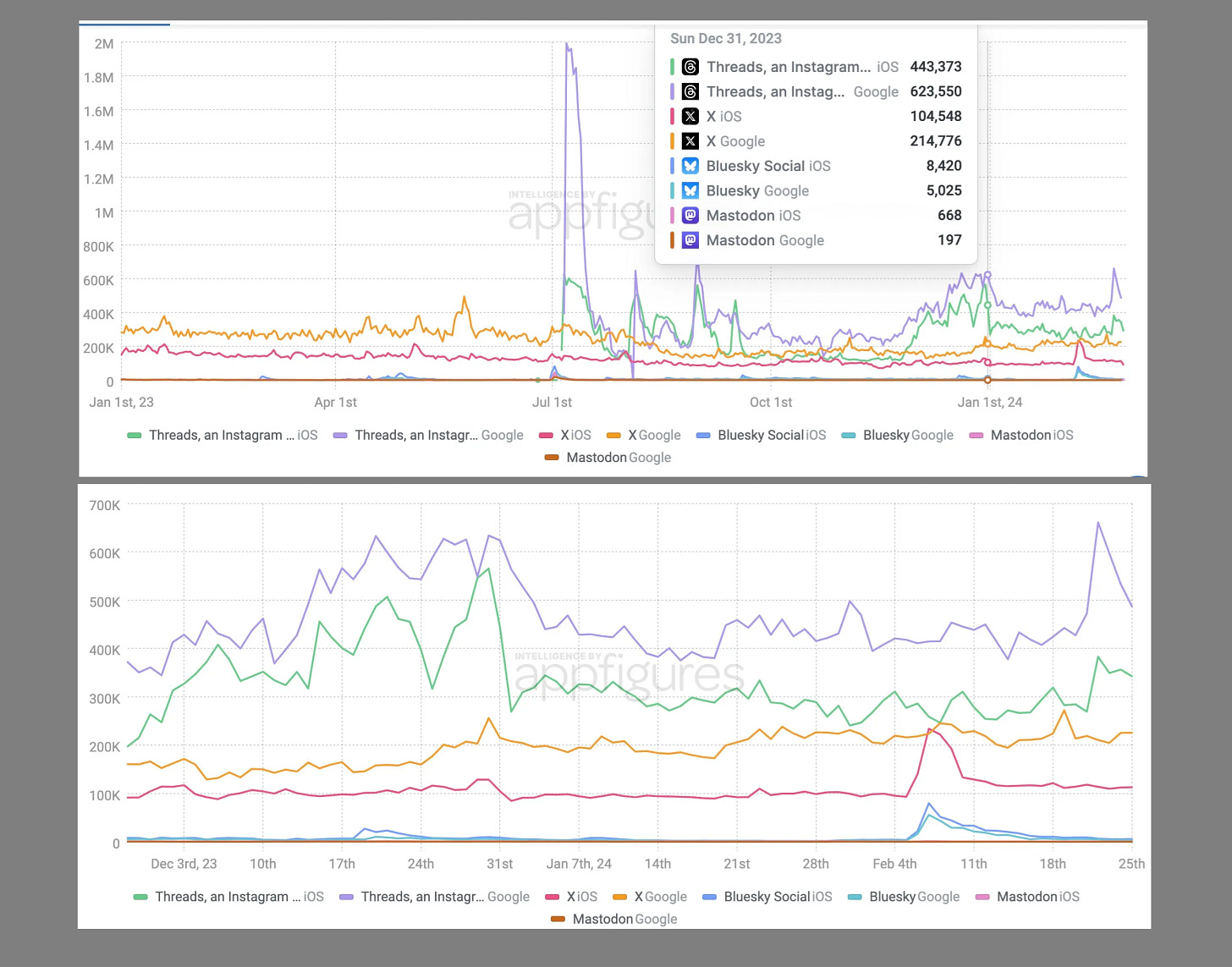

Social Media:

Social media is fractured and fragmented. Twitter has given way to X.com, Threads, Bluyesky, and Mastodon. Viewers of short-form video can find it through TikTok, Reels, Shorts, Marco Polo, and who knows what else. Gen AI itself can capture attention, as Character.ai shows.

At the same time the landscape is fragmenting, the actual mechanics of ‘sign up for an app’ → ‘accidentally invite all contacts’ has gone away. A key viral step is significantly reduced. Users have control (which is good), but startups see decreased ‘virality’

At the same time, for a number of reasons, Platforms like Facebook, Linkedin, Twitter (now X) no longer optimize for external link distribution. Gaining a large following won’t drive the same type of results it did in the past.

Email: While email remains widely used, it is overcrowded, and highly filtered. Message filtering will only continue as LLMs summarize messages, leaving the actual content even less likely to be read.

Mobile and App Stores: The plateau of smartphone adoption combined with stricter gatekeeping from Apple and Google, limits opportunities for organic growth.

Paid Ads: Rising costs and lower returns on ad spend, exacerbated by competition and privacy-focused changes, make this channel less viable for scaling. Think App Tracking Transparency and GDPR.

The compounding effects of past cycles—where channels were growing rapidly alongside startups—are no longer present.

Traditional Opportunities With Scale

While traditional channels present challenges, new opportunities are emerging that Gen AI startups can leverage:

Email Resurgence: Paradoxically, AI-powered SDRs are creating a resurgence of email. Companies that are early to this trend could see some gains. While email could be effective early, AI SDRs will also lead to the decreasing effectiveness of email as a channel. A flood of email will lead people to tune out email, like they do text messages during the run up to elections.

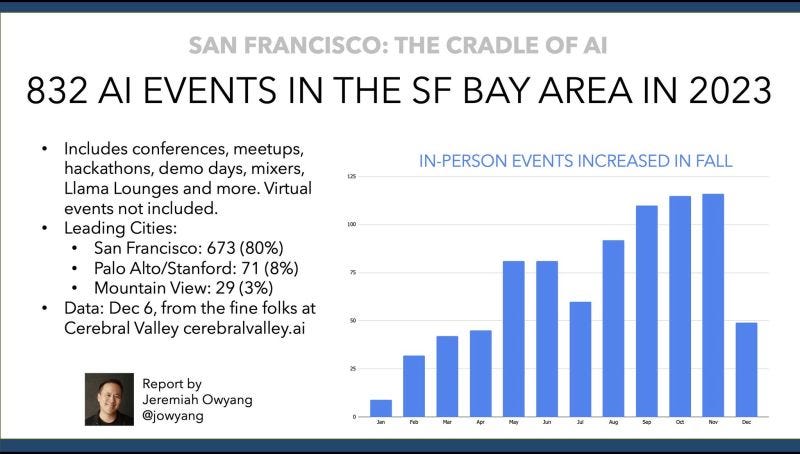

Live Events: After years of isolation during COVID-19, conferences and in-person events are regaining prominence as critical channels for enterprise-focused companies. San Francisco had 800 AI events last year. These events can be as simple as pizza and water (the AI group is a relatively sober group).

Connected Television Advertising: Advertising to streaming devices, has two positives: scale and measurement effectiveness. While linear television (traditional TV) doesn’t have the same reach, the ability to advertise to streamers is increasing. There are more streaming options than ever, and those players are increasingly introducing streaming tiers. Another plus is that smart TVs are actually trackable at an IP level, something that is fading out of use on web and mobile. The cost to produce television ad spots is decreasing, too. More supply, lower costs, trackable, it’s a good option!

Out of Home Advertising: Billboards, bus stop ads, BART takeovers (I see you Height Project Management app), these actually do work. And they work outside of the San Francisco Bay Area, too. Billboards can be secured digitally, and set up in trackable ways, too.

Brand: A unique brand can play a big role in driving sales, especially in categories that are relative commodities. This is not the post for brand metrics and brand building in an a Gen AI world.

These opportunities, though they work, require strategic execution, longer execution cycles, and higher upfront costs that the scalable, compounding channels that benefitted previous application waves.

Moving Forward

The situation for Gen AI apps today resembles the distribution landscape between the birth of the web and the rise of Google. Like then, there were a number of businesses that scaled revenue quickly and became well known. Like then, there was not a significant, scaling distribution channel. This was the era of the lavish party, expensive TV ads, and sock puppet mascots. A number of websites grew, did well-ish, but eventually folded. Pets.com, eToys.com, Monster.com, and a host of others.

The current distribution landscape requires fast experimentation loops, measurement, and intuition— a topic for the next blog post.

.

https://finance.yahoo.com/news/chegg-inc-chgg-q3-2024-071716975.html