My goal with this Substack is to publish once a week, preferably Sunday nights or Monday mornings. It certainly doesn’t always happen. This week, I’m late because of an Indeed investment event I helped organize in our ‘AI in HR’ event series.

Note, if you just want to know more about fundraising, skip to the bottom.

What is the ‘AI in HR’ event series

I started these events a year ago, inspired by the Llama Lounge events put on by Jeremiah Owyang. The first event we did just got together a bunch of founders, not too long after ChatGPT launched, and had them socialize. There were also some tabletop, “science fair” style demos. No intro, no agenda, just socializing.

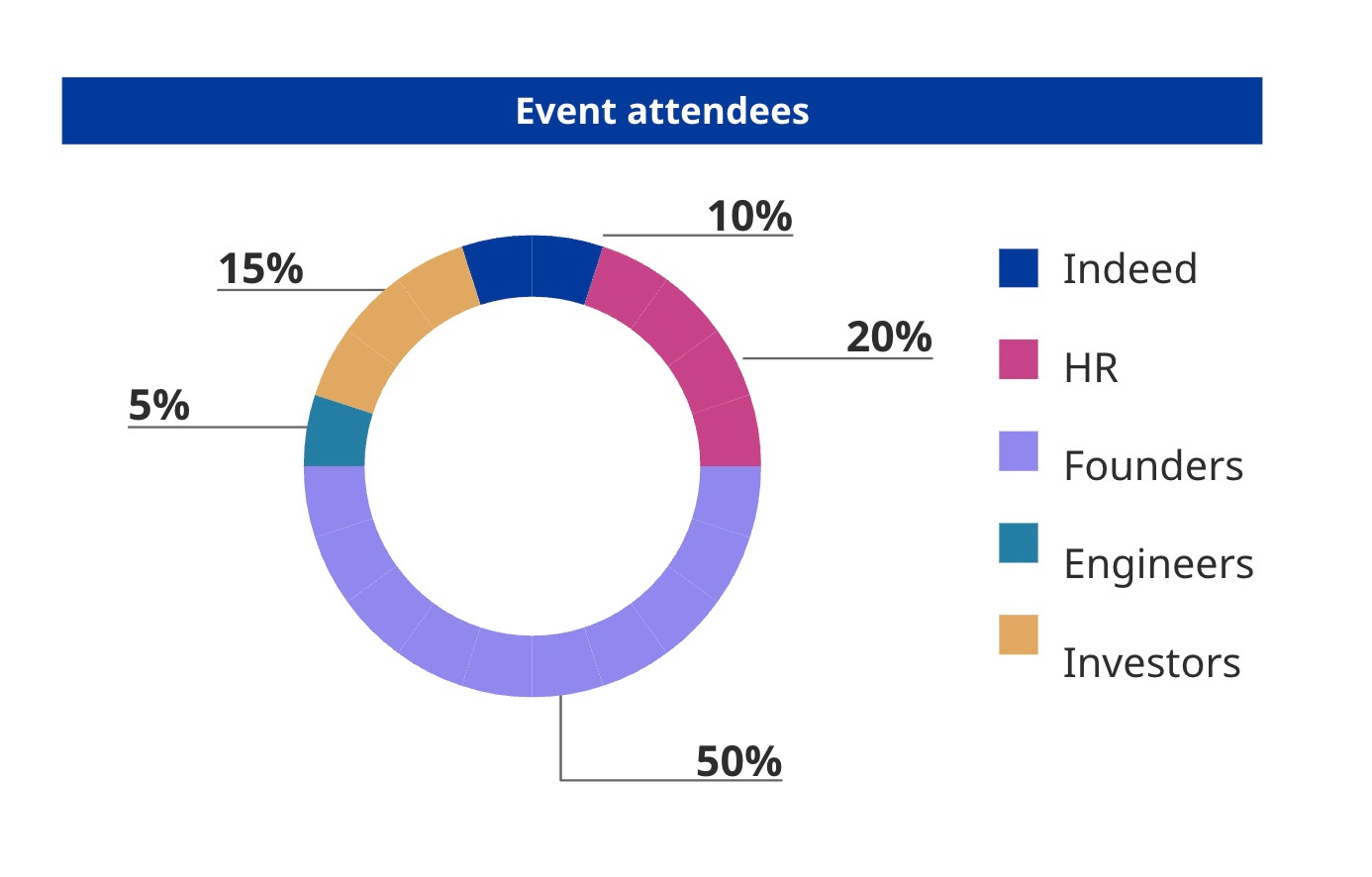

Over the year, with events done about every 2 months, and we’ve had over 500 startup founders RSVP for the events! Founders range from pre-seed to Series C. What’s unique about this event, though, is that we bring together more than founders and investors. We also bring in HR professionals (and some engineers).

.

Capping off a year with a special event

At each event we’ve tweaked the format, stepped up the organization, and added intros, themes, panelists, and just this past one “pitch” style demos. The demos were done in front of the audience plus a fantastic panel for Q&A. These were founder friendly events, but we had:

Anne Dwane, the co-founder & partner of Village Global, who also started Military.com and was CEO at Zinch. If you’re a pre-seed founder, check out https://www.villageglobal.vc/velocity.

LaFawn Davis, Indeed’s Chief People & Sustainability officer, who is an angel investor as well.

Chris Hyams, Indeed’s CEO

Raj Mukherjee, Indeed’s EVP of Product

Owen Humphries, Glassdoor’s COO

It was an insightful group, especially as it relates to the future-of-work. All are individuals who have thought very deeply, for long periods of time, about how work happens today and how it will evolve.

I’ve been hesitant about doing demos in front of the audience for a few reasons. One, it’s not easy for founders, they have to spend time preparing. Two, pitching an audience is not everyone’s strength. Three, it can be hard to keep audience engagement. This group of founders showed me I was wrong.

The startup demos

We had excellent demos from a number of companies:

Apriora.ai - An AI interviewer or “The world’s best”

Confirm - A talent intelligence platform for the power law organization

The Swarm - A tool to help companies and investors find talent

TrueWind - AI driven bookkeeping

FinalRoundAI - An AI interview copilot for job seekers

In addition to the “pitch” style demos, we had “science fair” demos from great companies as well:

Aeqium - Compensation planning

Audo - AI career concierge

Brix - AI talent matching for HR

Recruitbot - AI sourcing

TeamOhana - Workforce planning bought by finance, used by hiring managers

There was also a good size, attentive audience.

Followed by some solid networking.

Demos are great, but what about fundraising?

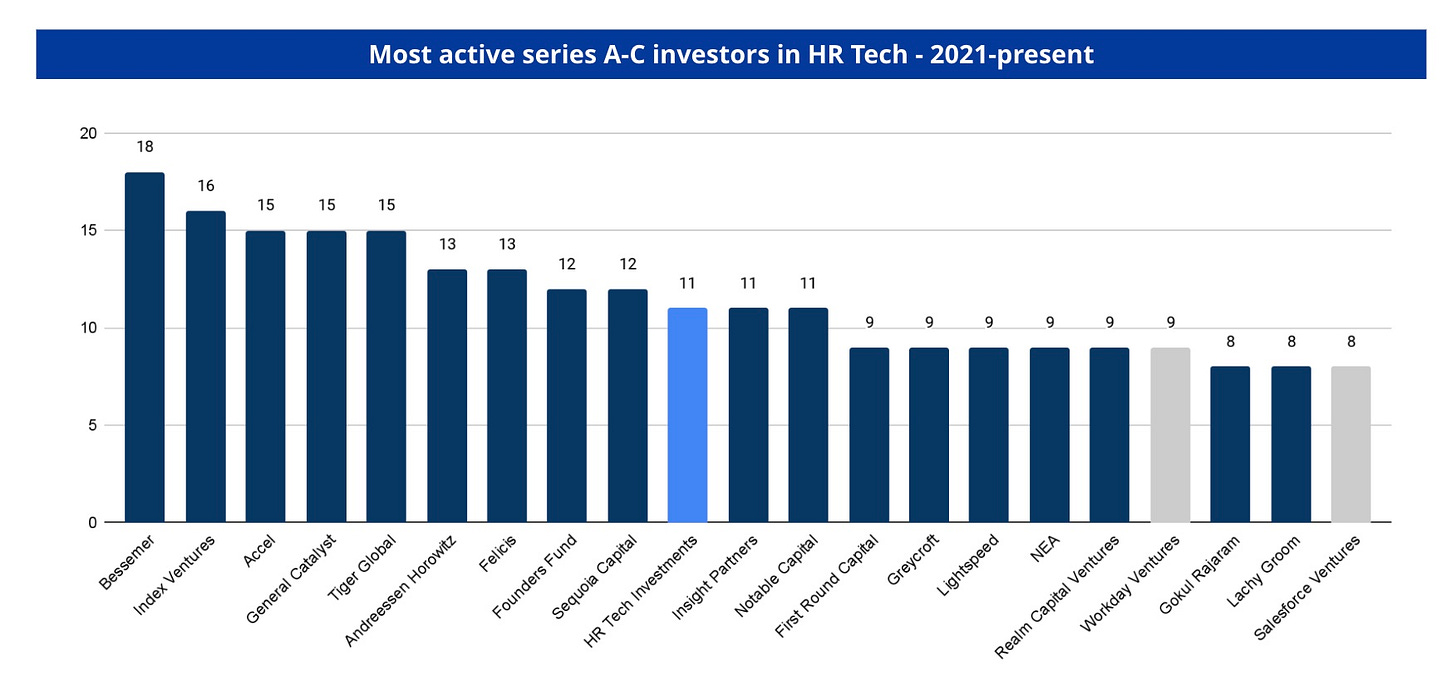

Indeed Investment team was there, of course, and we’re worth speaking to. We invest into Series A through C companies in HR Tech, the future-of-work, Talent Acquisition, FinTech, and Education. (Note: If you’re a robotics company, feel free to reach out, too). For the sector, we’re one of the more active investors (please see the footnote for more detail).1 If you think we’re a good fit, please feel free to submit your startup information here.

We had about 20 other investors in attendance: Amity Ventures, Bayview Development Group, Bosch Ventures, an investor from Elad Gill’s Fund, Embedding VC, FPV Ventures, Hanwha Asset Management, Mawer Capital, Micron Technology, Primary Venture Partners, Reach Capital, Sony Innovation Fund, & Yamaha Motor Ventures.

And, if you’re a pre-seed founder, definitely check out Village Global’s Velocity Program.

Thank you to all of the founders, investors, panelists, and Indeedians that made this happen.

Back to regularly scheduled program— This has been a busy two weeks in earnings season, so expect a write up on payroll and staffing earnings this weekend!

Note on this chart, two excellent work tech investors are not included: Acadian Ventures ( a newer fund) and SemperVirens (who was actually *the* most active). ADP also launched a venture fund in the past year.