Summary

I am invested in dozens of Special Purpose Vehicles (SPVs), have syndicated a handful of SPVs, done direct angel investing, and work in a corporate venture capacity. Over time I’ve encountered major challenges with SPVs that have caused me to approach SPV in a more cautious way. Before investing in an SPV, one should be aware of some of these challenges. My hope is to highlight some under-discussed concerns, suggest some simple improvements, and provide good onramps to investors that save them money.

As a helpful guide, this post is divided into three sections:

Section I: Basics of SPVs - explaining what they are and the value they provide. Feel free to skip if you’ve set up and run your own SPVs.

Section II: The challenges with SPVs – the main reason this post exists

Section III: Recommendations on improving SPVs, alternatives to SPVs, and finding great syndicates

🚀🚀🚀🚀🚀🚀🚀🚀

Section I: SPV Basics

What are SPVs

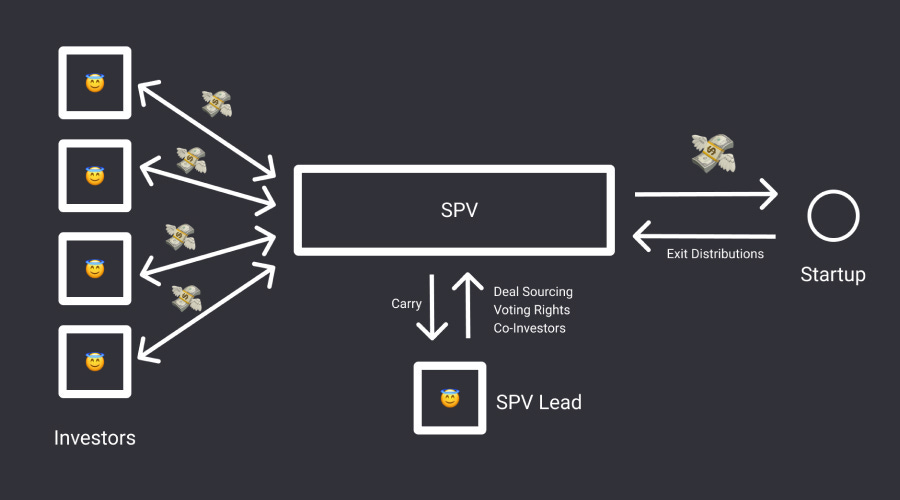

Special Purpose Vehicles (SPVs) are a specific Limited Liability Company (LLC) formed to invest in another company. SPVs enable investors to pool capital and rights, simplifying startup’s administrative burden around accepting investors. This makes it easier for a startup to accept more investors.

Most SPVs for startup investing are formed through a specialized platform that handles all of the paperwork, collection of funds, and transmission of funds between the SPV and the startup the SPV is investing in.

SPV platforms manage the SPV process

Forming and administering SPVs requires legal work and communication. Angellist, and formerly Assure, built software platforms and legal teams to:

Handle legal requirements like Know Your Customer

Facilitate the paperwork related to the LLC formation and private placement

Bank account creation (to send and receive funds)

Taxes (for a special type of tax form called a K-1)

Distribution and tracking of returns

SPV platforms charge ~$8k to set up the SPV, plus additional fees for any eventual distribution of returns to the LLC members. Typically, the time between setting up an SPV and distributions will be 3-7 years, similar to how long it takes startups to see an exit.

This is important to note because the cash flow of these businesses is weighted to the initial formation of the LLC, that is, syndicate platforms get paid up front. Syndicate platforms then have a liability (processing distributions) of unknown duration (when it will happen) and complexity (what the distribution will actually be: stock, cash, IPO, bankruptcy).

SPVs open angel investing to more people.

Why SPVs became so popular

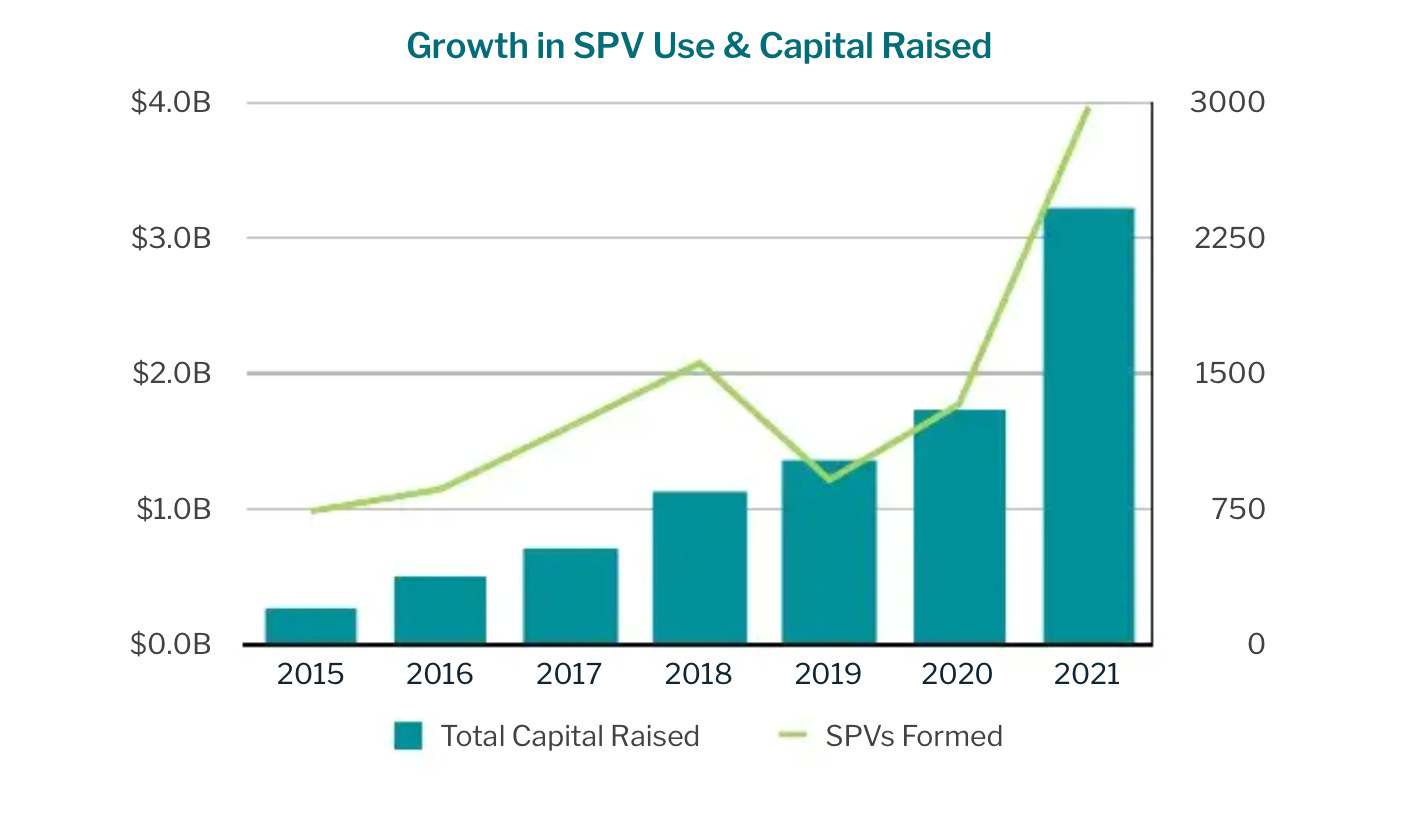

SPVs boomed the past ten years, driven by two key trends.

SPVs lowered the price point to become a startup investor. Prior to SPVs and syndicated deals (a way of referring to these SPVs), to invest in a startup typically required a check of $25k or more. Given the legal complexity of handling investors, most startups would only take on the burden of an investor at a sufficient check size. This was typically $25k, but for high value add investors, it could be lower.

Venture capital and angel investing became incredibly popular as interest rates fell, pushing investors to look for higher returns. From 2010 (when Angellist was founded), until 2022, the amount of venture capital invested in the US went up nearly 6x from $30B/year to $190B a year.

Prior to SPVs, startup investors had to write larger checks or invest through VCs.

Note: There were regulatory changes that also enabled the rise of SPVs. For a good overview, please check out this post on the ‘Last Money In’ newsletter.

How do SPVs check sizes compare to other ways to invest in startups

Investing in startups was typically limited to venture capitalists, successful startup founders/execs, and high net-worth angel investors. Check sizes for angels were $25k plus, while angel networks might pool together $100k to $500k, and then venture capitalists would do $500k plus.

SPVs brought the price down to a more accessible level, as low as $1k, providing a way for those new to startups and investing to get involved. Typically these syndicated deals are organized by a syndicate. The syndicates can be led by one person or a small group of people.

A smaller check size comes with a different challenge: incentive alignment, risks, and fees.

Section II: The challenges with SPVs

Show me the incentive, and I will you the outcome, - Charlie Munger

Incentive mis-alignment is the core challenge with SPVs

There are three core parties with most angel SPVs:

you (the investor)

the syndicate/SPV lead

the syndicate platform

All three parties want an investment to exit with a great return, but the syndicate lead and the syndicate platform's interests are more aligned with each other than with your aims. Both syndicate leads and SPV platforms are incentivized to do as many deals as possible.

Syndicates maximize their return by doing as many deals possible

“The absolute best way to make money [as a venture capitalist] in venture capital is to not have a fund and do SPVs” - Sam Lessin, Slow Ventures1

SPVs charge carry on a per deal basis. If a specific deal makes $100k in profit, the syndicate that organized the SPV, will take $20k on that deal. If a deal loses all of its money, the syndicate gets nothing. However, this loss does not reduce a syndicate's carry on future gains.

Comparing Venture Capital (VC) with SPVs highlights the differences in how investing losses impact future profit, or carry. VCs (heavily simplified) get paid on the overall profit of the fund while SPVs pay carry on only profitable deals.

For demonstration, let’s compare a venture fund and a syndicate investing in four deals at $100k per company. For this example, three of the companies went out of business losing all money, while one company returned $1M to the investor.

In this example, the VC and the Syndicate invested in the same deals, had the same returns, but the returns to the investor were different. The losses in the venture fund counted against the total profit the VC could collect. Leaving more for the investor.

Syndicate platforms need deals to keep coming in.

The bulk of payments to an SPV platform come when setting up the SPV. In order to keep growing, SPV platforms need a growing flow of deals. The incentives of Syndicates and SPV to maximize deal counts are born out in what actually happens.

There are syndicates that invest in over 100 deals a year. While partially explained by stage, this is a lot of deals. Comparing to other seed stage funds helps put the number in context.

Examples of deals per month for a syndicates, as reported on Angellist

A seed stage firm like Founder Collective, where members are regularly listed on the top investor ‘Midas List’, might do ~25-50 deals a year, across four+ partners. That’s 6 to 12 deals per *partner*. Benchmark, a firm focused on Series A, might do one deal per partner per year.

This high deal volume is coupled with additional counterparty risk and higher fees that eat into investor returns.

Hidden risks and fees that eat into returns

“Investors need to understand not only the magic of compounding long-term returns, but the tyranny of compounding costs; costs that ultimately overwhelm that magic.”

― John C. Bogle, founder, Vanguard

SPV investing entails a risk and costs seldom directly considered. Counterparty risk and setup fees. Counterparty party risk is the risk that a party in the transaction fails to live up to their agreement. In this case either the SPV platform, the syndicate lead, or both. The fees are the costs of forming an LLC to invest into a startup.

Counterparty risk

Syndicate leads are often a single individual, maybe a handful, that manage the details of the deal. While software platforms make this easier, there is a real risk of syndicate leads being unavailable for a variety of reasons. With a direct investment into a private company, you are dealing with one organization: the startup.

With the SPV, you are now dealing with three organizations: the startups, the syndicate lead, and the platform administering the syndicate. Should something happen to the syndicate lead, there might be few people to take over administration. Should something happen to the syndicate platform, it's then on the syndicate lead to handle the transition and replacement. This will incur new fees and might also mean some other risk or liability. An example of this is when Assure.co, previously a leading SPV platform, shut down unexpectedly in late 20222.

Fees

As mentioned above, SPVs charge a setup fee and carry. These fees reduce how much you invest in a startup and the profit you see. These fees can be a substantial drag on overall performance.

Another core area where SPVs might disadvantage the SPV investor is access to information.

SPV investors get less information than other investors

Syndicates typically write smaller checks than VCs and have less “social” power than other players in the space. This smaller scale investment limits influence and access to information.

VCs, with their larger investments, can secure board seats and information rights, granting them regular updates on company performance and additional investment protections. VC’s extensive networks also enable them to perform thorough reference checks during fundraising or executive hiring processes.

In contrast, SPVs, with potentially up to 249 investors, may not have direct relationships with the entrepreneur or other investors. This anonymity raises concerns about information leaks to competitors, hindering the flow of information to SPV investors.

As a result, SPV investors may find it challenging to assess the performance of their investments in a timely manner. Delays in public announcements of financing rounds and updates on investment valuations, such as those on platforms like AngelList, can further exacerbate this issue, leading to a lag of up to nine months in receiving crucial investment performance data.

Other items to note with SPVs

Limited liquidity

Startup investing is illiquid. However, the additional legal layer of the SPV adds another form of illiquidity. With the slower time to IPO, there has been a growth in platforms offering to make markets with the common and preferred equity of startups. Investing into an SPV is actually getting interested into an LLC, that then invests in the startup. Buying and selling of SPVs are rare and more complex than the underlying stock. This makes an illiquid investment (startups) even more illiquid when done through an SPV.

Selection bias

The types of companies that are available for syndication are different from the ones that get snapped up fast, with the whole round taken by leading VCs. If you’re getting into a syndicated deal, it’s going to often (though not always) be because someone with more money, knowledge, and experience didn’t want to take the whole round. People make mistakes. Good deals DO make it to syndicate platforms, but be thoughtful. An example of an excellent syndicated deal is Uber, which raised on Angellist, through First Round Capital’s Companion Syndicate.

K-1s and Taxes

Special Purpose Vehicles report taxes through K-1s. Every lead of the syndicate is supposed to send out a K-1 related to gains or losses of the SPV. This essentially guarantees that you will need to file an extension for your taxes. The more SPVs you invest in, the more K-1s you have, the more time an accountant (or you) will have to spend doing your taxes. Some platforms, like Angellist, handle K-1s well. Not everyone has an issue with K-1s, it depends on the syndicated platform.

Information asymmetry about the syndicate performance

When investing through an SPV, you will be unlikely to know the Syndicate’s investing record. No platform currently reports a syndicate's financial performance. There are no measures of rates of returns or distributions versus paid in. No platform reports how often you’ll get investor updates, either. Syndicate leads know this information, but you don’t. This just puts you at a disadvantage relative to the Syndicate lead. This is something SPV platforms could address.

Section III: Recommendations to improve SPV investing, alternatives to SPV investing, and finding good syndicates

Since startup investing can be fun and produce good returns, SPV platforms should improve SPV investing. Until that happens, there I’ve provided a list of suggested alternatives to SPV investing AND how to identify good syndicates.

Three key ways to improve the SPV investing performance

The fundamental issue with SPV incentives is harder to fix, but transparency would help change behavior. To that end, there are two key reporting changes and one platform product change syndicate platforms could introduce.

Report on Syndicate performance

The biggest value add is to show more details on the syndicate performance. Specifically, the same type of metrics that would be used to evaluate venture fund performance: IRR (internal rate of return), TVPI (total value versus paid in), and DPI (distributed versus paid in). DPI seems easiest to include because the syndicate platforms *also* handle the distribution. It’s possible that the right information for IRR could be hard to come by, but the platform knows how much capital was paid into a syndicate and how much was distributed out. Providing a view on DPI would help LPs understand which syndicates actually generate returns for their investors.

Provide transparency on investor updates

Syndicate platforms are messaging gateways that make it easy for syndicates to communicate with SPV LPs. Syndicate platforms could provide visibility on the frequency of investor updates so LPs could reasonably know if they will get investor updates or not.

Limit low performers and low transparency syndicates

AngelList could start leveraging the above information to help classify how good syndicate leads are. Syndicates that are seeing poor DPI and limited transparency could have more limited reach of LPs or higher fees. High volume, low performance syndicates are the ones most likely to produce bad results for a large number of LPs. Protecting LPs from these syndicates is in the long term, best interest of syndicate platforms.

Alternatives to SPV investing

Public market investments!

If you want the possibility of a 100x return, information on a company's performance, insights on management, low fees, and a high quality company, it’s hard to beat public markets.

Direct investing

Investing directly in a startup. This typically requires a relationship with the founder and likely $10k per deal. Founders ultimately decide what size check to accept. I’ve seen angels let on with just $2500. Benefits: you have the relationship with the founder, lower fees and easier from a tax perspective (no k-1s).

Roll Up Vehicles (RUVs)

AngelList created a ‘Roll Up Vehicle’, a type of SPV run by the startup founder as opposed to the SPV lead. Benefits: lower fees (no carry, waived LLC fee, if the founder is using Angellist Stack) and a relationship with the founder.

Scouting/Referring in deals

A number of venture capitalists will share carry with people that refer to companies that the VC invests in. Some venture funds have very open carry share programs, others require knowing the VCs in some way. Benefits: carry without investing anything.

If you are going to invest through syndicates, here’s how to find good syndicate leads

Read

Before investing, it’s important to understand the landscape and the rules of the game. I’d recommend:

Angel - Learn about angel and syndicate investing by the third or fourth investor in Uber

Venture Deals - A great primer on the venture process AND venture deal terms. This book was required reading when going through Techstars. Don’t get surprised by anti-dilution provisions or ratchet clauses.

Power Law - A great primer on venture capital strategy and history

Syndicate due diligence

Reach out to LPs of a syndicate and ask them about their experience with the syndicate: how responsive are they, do they provide access to valuation multiples, how often do they get investor updates.

Questions to ask syndicate leads

It’s worth reaching out the syndicate to understand:

How they get access to deals

Why founders let them into a deal

How they choose deals

What types of deals they’d turned down and why

What record of their own performance they have

What rights they typically negotiate with the founder

Invest with a group

Find a group of fellow investors. Share notes on syndicates, angel investing, and technology trends. Specifically, I highly recommend Hustle Fund Angel Squad as a way to learn more about angel investing in a social way. Disclosure: I’m a Hustle Fund Angel Squad life member and Hustle Fund LP.

There are Good SPVs and Great Syndicates

While I’ve written about some challenges with SPVs and syndicates, there are, in fact, a number of great Syndicates that entrepreneurs and investors find valuable.

Alumni syndicates help founders and alumni

SPVs can also benefit founders, especially early on, when founders need early checks to build momentum. Checks that come from an Alumni syndicate, e.g., Uplyft, provide social proof about the founders, too.

Syndicates that give SPV LPs direct access to the entrepreneur

High quality syndicates will provide access to the founder to hear the pitch directly and get questions answered. Examples include, but are not limited to:

Hustle Fund

Launch.co

Vitalize Angels

Specialized Syndicates with unique deal flow

Syndicate leads that specialize in certain areas will have access to deals you don’t. This could include a specialization in a certain type of space/aviation tech like Paperjet Ventures, later stage deals that require multi-million dollar checks like IPO.club, or SPVs that diversify into a specific startup asset class, like YCombinator (YC) startups.

There are great syndicates, providing a high value experience to investors and a service to entrepreneurs.

Wrapping it up

Investing in startups, particularly in Silicon Valley, is an exciting activity. The rise of SPVs opened this activity up to more people, but investors and the industry would benefit by addressing some of the key challenges with SPV investing. Until some of the key challenges are resolved, investors should consider:

Low fee alternatives to SPV investing: direct investing, scouting, public markets

Conducting due diligence on syndicates

Being more selective when investing into a startup through an SPV than when investing directly. This is due to the additional risks, fees, and challenges specific to SPVs.

The past few years has seen an incredible bull market and SPVs are starting to play a meaningful role in startup investing, particularly in very early stages. SPVs are likely here to stay in some form, so hopefully the industry can evolve to solve some of the core challenges. This would open up the startup world to more people.

“Make Number Go Up, and The Problem With Nonprofits” timestamp 7:55, More or Less Podcast https://ti.theinformation.com/more-less-pod/

https://www.axios.com/2022/11/23/assure-shutdown-fintech-startup-investing

For comparison, the fund should have the management fee included. A venture fund would have cost the investor another $40,000 if invested for five years at a 2% management fee.

SPVs indeed require cash flow; above all, in the current scenario of companies staying private for longer, there is a difficult balancing act between more deals or cutting costs to stay alive until the last liquidity event. It is key that SPVs organisers have other sources of income other than the origination of deals, otherwise the agency problem becomes the dominant risk.

The most important takeaway from this analysis is the counterparty risk. It should be mandatory for SPVs to have a Business Continuity Plan like we do at IPO CLUB. This risk is real; many SPVs won’t pass the test of time, and their organizers and structures may disappear before the liquidity event. Stay Alert!

The need for more information on SPVs is also real, but a much smaller risk to investors. This is particularly true for late-stage ventures, as large, mature start-ups don’t care about SPVs that put in 10-20 million and often have terms that specifically cut off information shareholders below a % percentage (SPV owning $ 15 million of SpaceX does not even get annual accounts).

Limited liquidity is also another very sticky point. As correctly pointed out, it is usually harder to sell the interest in the startup than the shares of the startup. But we must remind ourselves that an investor with $50,000 cannot, in many instances, buy into the capital table of any start-up past the seed stage due to cheque size.

We welcome the key ways to improve the SPV investing performance; it’s a good starting point.

IPO CLUB reports performance regularly on its deck and website, but we need transparency on money-in and distributions (a poor track record for all VCs in the past three years).

IPO CLUB provides monthly updates but sometimes goes quiet in the summer, so ten reports a year can be expected.

Regarding Scouting/Referring in deals, is this even legal? In our understanding, the regulation forbids to pay any non-registered person.

Wrapping it up

Be mindful of investing in many SPVs; the counterparty risk is immense, the liquidity is bad, and the information is poor. Chose your fighters carefully and breath constantly down their necks. Stay hard!