2 lies and 1 truth about GPTWrappers

What "It's just a wrapper" gets wrong (and right)

“It’s just a wrapper! It’s not defensible”

“The venture model is dead”

“The first $1B, 1 person company will be made with AI”

Two of these are lies, one might be dead.

It’s just a wrapper!

The landscape of technology and venture capital is rapidly evolving, driven by advancements in AI and shifting economic dynamics. Common assertions like “It’s just a wrapper! It’s not defensible” and “The venture model is dead” reflect the growing debate around these changes. Amidst this, the bold prediction that “The first $1B, 1-person company will be made with AI” captures the imagination of many. Let's explore the veracity of these claims and their implications for the future.

It’s just a wrapper!

GPT wrapper apps are able to achieve millions of dollars in ARR in short periods of time, with minimal teams and products. These apps put a different UI and an engineered prompt on a foundational model API (initially OpenAI’s GPT-n). Every time OpenAI updates their model, a chorus of commentators goes online and and share insights like the one below.

There is some truth to this. If the GPT wrapper provided a single point of functionality and no other benefits, then, perhaps, yes. Chat with a PDFs, build a resume, share a chat. If the wrapper did only that, then it might have been sherlocked1. However, something else is going on with this.

Technology history shows us that at the beginning of a platform shift, it’s cheap and easy to build a solution that gets usage. The companies that make it out of the early dates have to continue to build additional functionality to stay relevant. For later entrants, the needed features to make it to the consideration set, the solid mental model of the market, and the lower willingness of customers to try new solutions raises the investment required to enter the market. At the same time, companies that adopted the new initial solutions integrate those tools into their workflows and train employees how to use the tools. The increased investment cost plus vendor lock in serves are barriers to entry, resulting in good profits — for those solutions that make it out of the initial days. This is demonstrated over and over again.

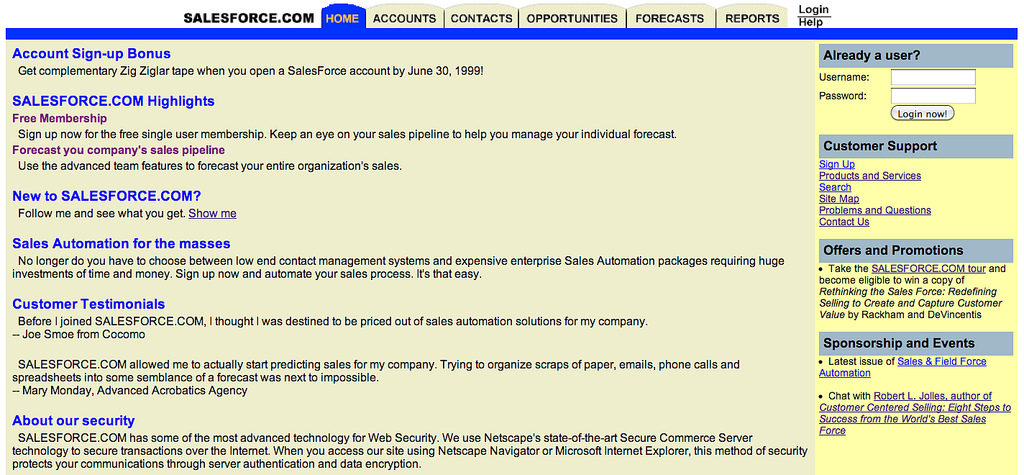

The first commercially successful cars lacked many parts of what automobiles would need even ten or twenty years later. The first PCs had to be assembled by the buyers, and came without a case, keyboard, or screen. The first web sites did little. The first SaaS apps provided little more than a UI wrapper around SQL write and read statements.

Not only were the initial inventions simple, startup costs were relatively low, too.

Ford Motor company was started with $100k in 1903 ($3.5M today)

Apple raised $250k in 1977 to get started and $3.7M (~$14M today) to make it to IPO in 1980, already doing $117M in revenue at the time of IPO

Microsoft was able to bootstrap, raised $1M, but never needed the funds.

eBay used $6.7M (~$13M today) to make it to IPO

Compare those prices with the amounts needed to break into markets at a later stages, and it’s clear that it’s much cheaper to enter a market when its emerging. To successfully enter a market at later stage means building “best-of-suite” offerings that provide everything the “best-in-breed” solutions do plus more, at a lower price. Building these capabilities takes time. Marketing takes money. This raises the cost.

Workers learn the initial toolset, companies implement workflow around the tools. When a worker that learned a tool joins a new company, they’ll often suggest the familiar tool. These effects all serve to decrease the willingness to try new vendors.

It happened with operating systems, PCs, phones, and SaaS. Gen AI apps will behave the same way. A question becomes what this means for Gen AI application investors.

Venture capital is dead

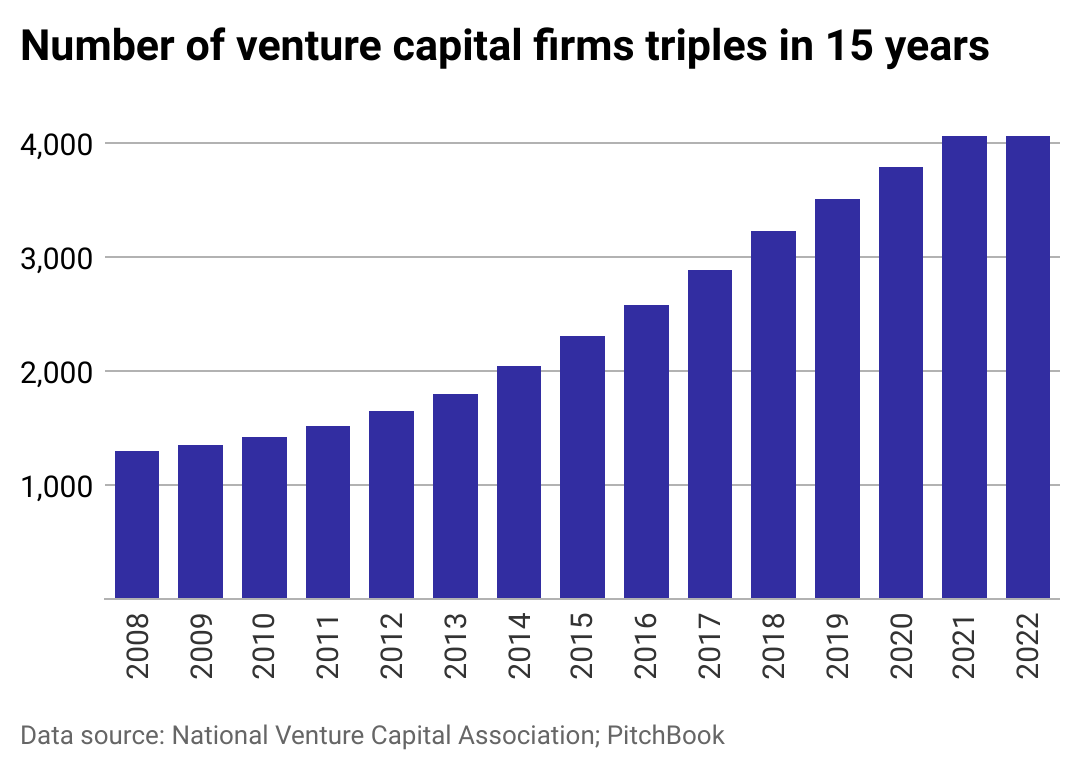

As a result of the easy success of Gen AI applications, plus the fact that Gen AI can improve productivity from 30 to 50%, some venture capitalists have said the VC model is broken, or dead. While actual Gen AI funding might reveal a different belief, there is something worth noticing.

A primary driver of the “VC is dead”, related to Gen AI specifically, is that Gen AI makes people more productive. Companies need to hire fewer people. Headcount is the largest budget of most startups. If this falls, the amount of VC needed decreases, too. This is just part of an on going trend.

As distribution channels reach more people, transportation costs decrease, and production costs continue to decline, firms are seeing continued increases in revenue per employee. Firms need fewer employees. This trickles to startups, too.

A countervailing force that is not factored in is the end of cheap, effective distribution channels. The post-dot com version of the web had SEO, social media sites grew virally on growth “hacks”, consumer brands and mobile apps were able to leverage highly effective social media ads. SEO is declining, growth hacks are shut down, and effective social media advertising is increasingly tilted towards large brands.

To build awareness and get sales, companies will have to invest more in marketing and advertising (eventually). So while it’s possible that the huge increase in venture capital after the Great Financial crisis broke the model, I don’t think Gen AI is the cause.

Instead, history has shown low interest rates cause people to chase yield, seeking riskier and riskier investments to achieve desired returns.

It is a fact of experience, that when interest of money is two per cent, capital habitually emigrates, or, what is here the same thing, is wasted on foolish speculations, which never yield any adequate return.

-Walter Bagehot, 18482

Higher interest rates should decrease LP demand for venture capital, hopefully drying out the market, and leaving enough economic profit to compensate LPs and GPs for taking highly risky, illiquid investments.

1 person, 1 billion dollars

A one person, $1B company might be a logical extreme of the improvements in revenue per employee over time. Tech companies can make millions of dollars per employee, but this doesn’t compare to what state-owned enterprises, finance companies, holding companies, and a few companies can make. Tech companies don’t even make the top ten highest in revenue per employee. And while there are companies that are 9 figures in revenue per employee, they are unique situations. Generative AI would need at least a 50x efficiency gain to come close to this, well above the optimistic 50% observed in very specific controlled studies.

What comes next

The current frenzy of building and investment activity maps to past platform shifts and opportunities. It’s useful to bring the lessons from history to examine these opportunities as a founder and an investor. As a founder, it’s possible (though unlikely) to make it out the otherside with a thriving business. It will need to start with strong customer empathy, fast iteration cycles, and building towards tools that “lock” companies in. As investors, it’s about picking the right team (as always) and see what markets will lend themselves to lock in.

https://www.howtogeek.com/297651/what-does-it-mean-when-a-company-sherlocks-an-app/

The Price of Time, Edward Chancellor, page 62