Workday Q1 2025 earnings and implications for HR Tech SaaS

Headcount headwinds and sales complexity

Workday’s 30% stock decline

Workday’s stock has fallen 30% in the past 4 months, despite growing close to 20% a year at nearly $8B/year in revenue. The stock dropped because Workday lowered its expected revenue growth multiple times, and came in light on its most recent revenue. The company is hitting similar macro conditions as HR Tech and SaaS.

These trends affect not just the enterprise, but also startups, and are worth recognizing throughout the investing stages. Particularly as the larger trend of SaaS solution consolidation comes with a trade off of more complex deals. Emerging SaaS companies should consider how these trends affect their pricing and go-to-market strategies.

3 factors affecting Workday’s performance

Workday has reported issues in key areas:

Companies reducing expected future headcount, slowing expansion growth.

Higher deal scrutiny given the macro.

More complex deals as Workday sells not just into HR, but also into Finance.

Lower headcount growth affecting sales

Workday’s CEO, Carl Eschenbach, called out lower headcount growth as a damper on expansion in his prepared remarks.

We are seeing customers committing to lower headcount levels on renewals compared to what we had expected. We expect these dynamics to persist in the near term, which is reflected in our revised FY 2025 subscription revenue guidance.

Job posting data from Indeed highlights the tailwind in headcount expansion that was happening 2 years ago, versus the moderation in headcount growth today. Job postings grew significantly coming out of the covid lockdowns and have been declining since the beginning of 2022. The pace of the decline has accelerated in the past quarter.

Headcount growth has been a minor growth driver of SaaS for years, not just for during covid. Per seat pricing has captured the natural headcount growth of firms. In the current push for efficiency, companies are hiring less. This is lessening the impact of headcount expansion on revenue. Deals aren’t just renewing at lower future headcount, they are also taking longer to close.

Higher deal scrutiny and longer closing times

Deals are taking longer due to the focus on cost efficiencies. This focus on efficiency is both a result of the current macro environment, but it’s also a result of a wider product surface area. As SaaS products expand their product portfolio, the issues they solve, the contract cost goes up. These two aspects will drive more scrutiny and slow down the sales process. Workday CEO, responding to an analyst question about whether AI budget is boxing out SaaS budget, responded a note on higher deal scrutiny.

We saw that. We talked about that last week on our earnings call. In Q1, we saw probably a bit more scrutiny than we've seen the last year when it comes to big transformational deals or platform deals where people are thinking about putting in a new HCM platform or people putting in a new ERP platform or financials. These are big investments people have to make, not just in technology but there's a services component to it as well. So I just think people have taken a little bit of pause.

Salesforce, reporting on their most recent earnings (that also lead to a 20% stock drop), echoed similar sentiments. Brian Milliham, Salesforce’s President and COO, had this to say:

We continue to see the measured buying behavior similar to what we experienced over the past two years and with the exception of Q4 where we saw stronger bookings. The momentum we saw in Q4 moderated in Q1 and we saw elongated deal cycles, deal compression and high levels of budget scrutiny.

Paylocity, in their earnings call, provided a more specific guide on the tactical impact of longer deal times.

When things are challenging from a macro perspective, things stay in each of those stages for longer. So if it usually took us 35 days to go from one stage to the next, and all of a sudden it's taking us 55 days that's an indicator.

And as long as you're not losing them off the bottom and your win rate is staying relatively similar, that's how we really kind of come to the conclusion that there's some macro uneasiness going on there.

SaaS companies across the spectrum of software type and industry segment are reporting longer deal times. Part of this is economic cycle, part of this could be the push towards consolidation, or “compound startups”.

As SaaS companies move from offering a point solution one buyer, e.g., an HRIS to HR or a Recruiting Automation solution to Talent Attraction, to a comprehensive suite of solutions to multiple buyers, deals become more complex. Complex deals involve more people and take longer to close.

Complex deals taking longer to close

Building products with a larger surface area increases contract size and (likely) improves retention. These benefits come at a cost in the sales price — higher complexity. Complex deals require more decision makers and stakeholders, taking long to sell. When discussing deal times, Workday CEO had this to say about deal complexity:

When we sell full platform, particularly in the large enterprise market, we are selling to multiple buyers. We're selling -- selling to the CHRO. We're selling to the CIO and the CFO, which makes it a little bit more of a complex deal for us, which makes some of these sales cycles a bit longer.

While these deals might take longer, it still works as a strategy. Workday’s Financial offering (FINS) is growing at 20% year-over-year, faster than the HCM part of its business (Although HCM is growing off a larger base). There’s value in having a complete product solution.

Private companies like Rippling and Pigment have a similar approach to Workday. They’ve built out products that stretch from HR to Finance and beyond.

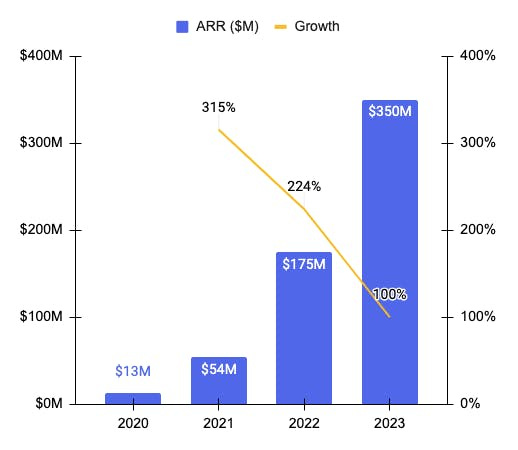

SaaS companies that have taken an approach to build out everything, are seeing strong growth. According to Sacra, Rippling grew to $350M in 2023, up 100% year-on-year. Pigment recently announced its series D.

It’s clear that this approach can work. And companies that can successfully build out high quality product, quickly enough, to pursue this approach, should do it. It just likely means a longer sales cycle.

Thoughts for SaaS going forward

Workday’s softening revenue expectations shows SaaS selling may become more difficult. Factors such as lower headcount growth, increased deal scrutiny, and the complexity of multi-stakeholder deals affect not just Workday, but the entire industry.

However, the company's continued growth in its financial offerings and the broader trend of SaaS consolidation indicate potential for long-term resilience. Emerging SaaS companies focused on an ‘all-in-one’ approach look positioned to do deal over this next secular shift.

Solid article, thanks. I would add that its important to call out the difference between enterprise and mid market motions. The headwinds that Workday says its facing are a result of selling multi product deals into large enterprises which require a disconnected set of influencers and buyers to agree. Rippling, etc., benefit from the sales velocity that comes from selling multi product platforms into the SMB/MM sector.