Warehouse Robotics Earnings: SYM, AutoStore, & Ocado Group

Robots dont need to be humanoid

Robots in the Distribution Center

Humanoid robots have been stealing the robot spotlight lately. Between Optimus, Figure.ai, and the screen-stealing qualities of Boston Dynamics, you’d be excused for thinking robots were going to make a difference in industrial settings… in the future.

In fact, thanks to a collection of familiar story tropes, a determined billionaire and a risk-loving Japanese company, Softbank, there are several publicly traded robotics companies in warehouse settings. Symbotic ($SYM), AutoStore Holdings, and Ocado Group all make and sell Automated Storage Retrieval System Robots.

Highlevel Company Overview

Symbotic, a US-based company, was founded by Rick Cohen based on his experience with his family-owned business, C&S Grocery Wholesale. Grocery wholesaling is a low-margin business; Rick wanted to improve on it and invested hundreds of millions of dollars to develop an automated warehouse system. Symbotic has a very large client in Walmart and a joint venture with SoftBank.

AutoStore Holdings is a Danish company that focuses on ASRS for Retailers and is particularly strong in Europe. AutoStore Holdings has over a thousand customers, targeting a very different approach than Symbotic.

Ocado Group is an online grocery retailer in the UK, that has opened up its robotic fulfillment warehouses and its logistics networks as separate businesses. Ocado Group sees the future of Grocery changing to an online model, with distribution centers and delivery. Ocado Group is having success in the US (Kroger) and in a number of other players in Asia and Europe.

Revenue and Margins

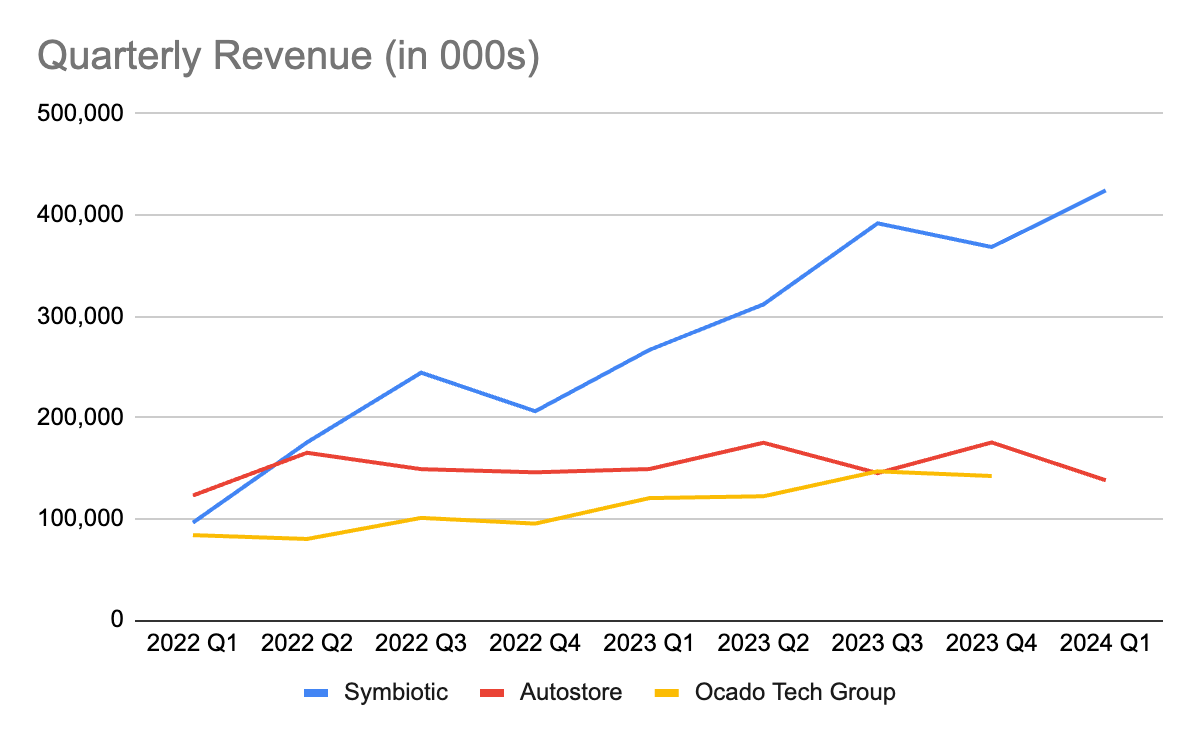

Symbotic revenue continues to surge driven by its deals with Walmart coming online and new deals. Symbotic has a $23B revenue performance obligation backlog that continues to grow. Note, though, that it counts 7 customers. And 2 of those are directly, or indirectly, through Symbotic’s CEO, Rick Cohen’s businesses (C&S Grocery).

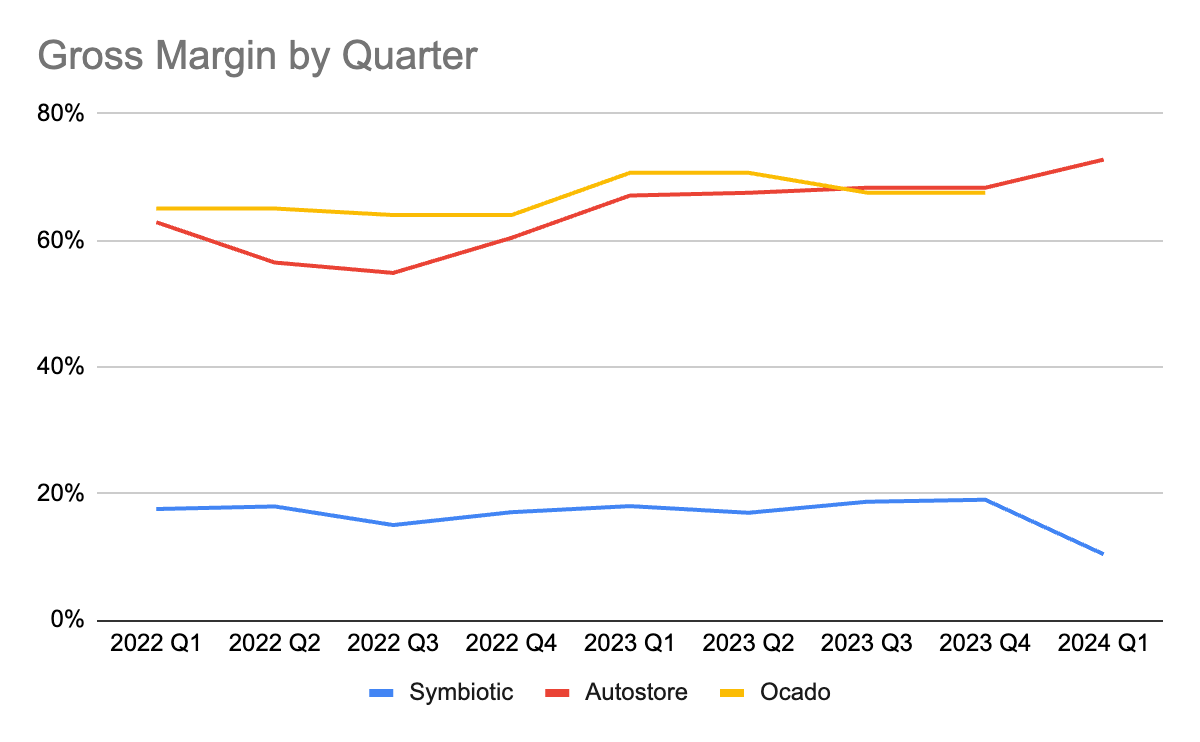

AutoStore and Ocado Tech Group (the robotics division) are seeing more moderate growth, with fluctuations as robots come online. However, growth is still strong. Looking past revenue at gross margins and the current profitability of AutoStore and Ocado stand out.

AutoStore and Ocadao Tech group are running at gross margins much more inline with software companies. Not all robotics companies achieve these margins (as $SYMB) shows, but industry leaders like Intuitive Surgical get up there. Overtime, Symbotic margins will improve as revenue consists of more stable operations and Symbotic diversifies its customer base.

Quarterly Earnings Calendar Year Q1 2024

Symbotic

Symbotic reported significant growth and innovation in the second quarter of fiscal year 2024. The company experienced a 59% increase in revenue year-over-year, reaching $424 million, primarily driven by the accelerated deployment of their systems.

Vision added to it’s robot: Continued advancements in AI and automation, including adding vision to its robots, improving its package identification capabilities. New bots are also making use of Nvidia GPUs. Vision in the robots also enables teleoperations for its robots for when a bot needs help.

Operational Efficiency: Standardization of SymBot for all future deployments and the outsourcing of manufacturing operations enhanced operational efficiency.

Market Expansion: GreenBox partnership with SoftBank acquired its first customer a quarter earlier than expected, C&S Wholesalers. Symbotic is moving into perishables, and testing out the bots in refrigeration.

AutoStore Holdings Calendar Year Q1 2024

Company Performance: AutoStore reported a solid order intake of $183 million, an 11% increase compared to Q1 2023, driven largely by high throughput projects. However, revenue for Q1 was $138 million, marking a 7% decrease year-over-year due to timing issues related to project schedules.

Financial Health: The company highlighted a gross margin of nearly 73%, attributed to effective product mix and operational efficiencies. EBITDA margin remained stable at 46%.

Market Position and Growth Strategy: AutoStore emphasized its strong market position with 1,450 systems and 67,500 robots installed across 54 countries. They continue to benefit from a base of approximately 1,050 unique customers. The company is optimistic about its growth potential, given that only about 20% of the warehouse automation market is currently penetrated.

Customer Base and Recurring Revenue: The company noted that recurring revenue, primarily from software and spare parts, makes up just under 10% of total revenues.

Ocado Group Technology Segment Line Q4 2023 Period

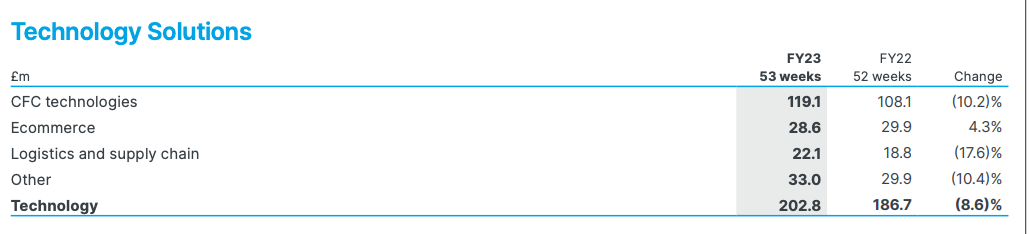

Revenue growth was driven by an expansion in both geographical reach and technological capabilities.

Notably, the introduction of "Re:Imagined" technologies has started to generate commercial results, enhancing operational efficiency across deployed regions.

The deployment of three new Customer Fulfilment Centers (CFCs) in the U.K., Canada, and Japan expanded Ocado’s geographic footprint.

The Ocado Smart Platform's performance remained strong, with consistent high Net Promoter Scores (NPS) across client markets, indicating customer satisfaction.

Technology Solutions is the global technology platform business providing OSP as a managed service to 12 grocery retail partners at the year end. This segment also includes the revenue and costs associated with the Group’s non-grocery business, Ocado Intelligent Automation (“OIA”), including Kindred and 6RS.

Robots, even those with AI, are making driving performance improvements to businesses today. The reasons companies choose robotics solutions are related to labor issues and acceleration of omni-channel retail, trends that will all persist.

**Disclosure: The author has a position in Symbotic Robots

Thank you, what do you think of https://urbx.com/ ?