The Real Force Behind the Robotics Boom: It’s Not Just Labor Shortages or AI Hype

Strategic imperatives and competitive dynamics

The conventional wisdom about the rise of robotics often points to a couple of well-worn narratives: demographic decline leading to labor shortages and the rapid advancement of artificial intelligence. These factors are indeed contributing to the increased adoption of robotics, but they don't tell the whole story.

The real driving force behind this boom is something more strategic and intentional: the relentless pursuit by companies like Amazon to build a better "Prime" experience. Amazon’s move have forced major retailers like Walmart and Kroger, along with global brands such as Adidas and Nike, to follow suit. This shift isn’t just about efficiency; it’s about staying relevant in an increasingly competitive market.

Setting the Stage: The Usual Narratives

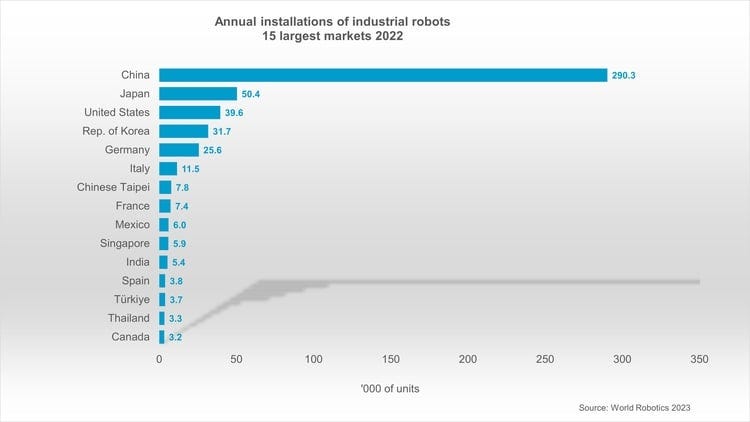

When people talk about the rise of robotics, the conversation often starts with demographic trends. Populations in many developed countries are aging, leading to a shrinking workforce. As labor becomes scarcer, the logic goes, companies are turning to robots to fill the gap. Charts like the one below, showing a high degree of robotization in countries facing demographic declines, support the narrative.

Another popular explanation is the rise of artificial intelligence. As AI technology improves, it’s increasingly being integrated into robotic systems, making them more capable and versatile.

Both of these narratives are true to an extent, but they don’t capture the full picture. Yes, labor has been scarce, and yes, AI is making robots smarter, but these are not the core reasons why companies are investing heavily in robotics today. To understand what’s really driving the robotics boom, we need to look at how companies are using technology to meet the demands of modern consumers.

The Real Story: Amazon’s Quest for the Perfect Prime Experience

Amazon’s success has always been about more than just online product sales. The company build its brand on the promise of speed, convenience, and reliability—values encapsulated in its Prime service. Prime started as a simple idea: offer customers faster shipping for a flat fee. But the value kept growing. The vision was always to create a luxury-like customer experience, ensuring that fast, reliable delivery became a cornerstone of the Amazon brand.

To deliver on that promise, Amazon had to continuously innovate its logistics and fulfillment operations. Over the years, this has meant a heavy investment in robotics, not just as a tool to offset labor shortages, but as a critical component of its strategy deliver the best ecommerce experience.

Amazon’s journey into robotics began in earnest with its acquisition of Kiva Systems in 20121. Since then, Amazon has transformed its fulfillment centers into highly automated environments where robots work alongside humans to pick, pack, and ship products with remarkable efficiency. This wasn’t just a reaction to labor market conditions; it was a strategic move to build a fulfillment network that could meet the demands of millions of Prime members who expect fast, reliable delivery.

Amazon has made significant investments and progress in its robotics journey over the past decade.

Ben Thompson, in his analysis of Amazon’s strategy, has emphasized how the company isn’t just building out its logistics for internal use. It’s laying the groundwork for what he describes as "Amazon as a service."2 Amazon’s investment in robotics is not just about improving its own operations; it’s about creating a scalable, highly efficient logistics platform that others can plug into.

Following the Leader: How Walmart, Kroger, and Major Brands Are Adapting

Amazon’s advances in robotics haven’t gone unnoticed. Retail giants like Walmart and Kroger have been quick to recognize that to stay competitive, they need to embrace similar technologies. But while Amazon’s use of robotics is often portrayed as the gold standard, Walmart’s approach has been equally significant, albeit different in execution.

Walmart knows it needs to keep pace with Amazon across ecommerce and logisitcs. Amazon acquired Jet.com, built out Walmart Labs, and is investing heavily into its fulfillment capabilities. Walmart invested over $500M into Symbotic, and is spending around 3/4 of a billion every year with them.

Amazon’s reach is not just typical ecommerce, but also online grocery and delivery. Since Amazon’s acquisition of Whole Foods brought them into delivery, they’ve changed how people are able to buy groceries. To keep pace, companies like Kroger are working with Ocado, a UK-based online grocery retailer known for its automation.

Together, they’ve developed highly automated fulfillment centers across the U.S. These centers are designed to handle online grocery orders with unmatched speed. Kroger can offer a great online grocery service that keeps pace with Amazon’s online grocery offering.

It’s not just the big retailers that are getting in on the action. Global brands like Adidas3, Nike, and Puma are also integrating robotics into their operations. Retailers like Puma are using systems from providers like Autostore to improve their efficiency and operations.

The AI-like Dynamics of Infrastructure

Artificial intelligence is often mentioned in the same breath as robotics, and for good reason. AI is making robots smarter and more capable. But the only story isn’t just about AI improving robotics.

The real parallel to the robotics boom is found in the world of hyperscaler investments in generative AI. Companies like Amazon, Microsoft, and Google aren’t just investing in AI to build smarter systems; they’re investing to dominate the infrastructure of the future. The billions being poured into generative AI are about more than just creating new products—they’re about controlling the platforms that will underpin entire industries.

In robotics, there is a similar (though more muted) dynamic. Amazon’s investment in fulfillment robots isn’t just about making their warehouses more efficient—it’s about creating a logistics platform of the future. This forces others, like Walmart and Kroger, to invest to keep pace. Their investments are building the infrastructure of tomorrow’s retail environment. And just like in AI, the companies that control the infrastructure will control the future.

The Real Drivers of Robotics

The real driver of the warehouse robotics boom? It’s not just demographic shifts or advancements in AI, though these factors certainly play a role. The real driver is the strategic imperative to meet the demands of modern consumers—demands shaped by companies like Amazon, which have set a new standard for speed, convenience, and reliability. To stay competitive, other retailers and brands are following suit, investing in robotics not just to keep up, but to stay relevant.

This isn’t just a technological shift; it’s a strategic one. Companies are not adopting robotics because they have to; they’re doing it because they want to win. Just as the race to dominate AI is about capturing the future of technology, the race to integrate robotics is about capturing the future of business.

Conclusion: The Future of Robotics and Strategic Advantage

The rise of robotics is reshaping industries, but it’s doing so in ways that go beyond the usual narratives of labor shortages and AI advancements. At its core, the robotics boom is about companies like Amazon, Walmart, and Kroger—and brands like Adidas and Nike—using technology to build better, faster, and more reliable operations. These companies aren’t just responding to external pressures; they’re actively shaping the future of their industries through strategic investments in robotics.

As robotics continues to evolve, its role in business will only grow more significant. Companies that recognize this and invest accordingly will be well-positioned to lead in the years to come. The future belongs to those who understand that robotics isn’t just about automation—it’s about building a strategic advantage in a highly competitive world.

Note: 1X from NEO launched last week, to read more about it, check out the Robots & Startups4 link in the footnotes

https://techcrunch.com/2012/03/19/amazon-acquires-online-fulfillment-company-kiva-systems-for-775-million-in-cash/

https://stratechery.com/2022/beyond-aggregation-amazon-as-a-service/

https://www.warehouseautomation.ca/news/adidas-launching-highly-automated-super-hub-apn4m-hp5j8