Payroll, staffing, soft landings, and pricing power

Q2 2024 staffing, placement, and freelance earnings survey

Payroll & Staffing reflect the attempted soft landing

This quarters payroll and staffing earnings are reflections of the economy try to stick a soft landing. The US labor market is lackluster at best. Unemployment is low, jobs are being added, but unemployment is climbing.

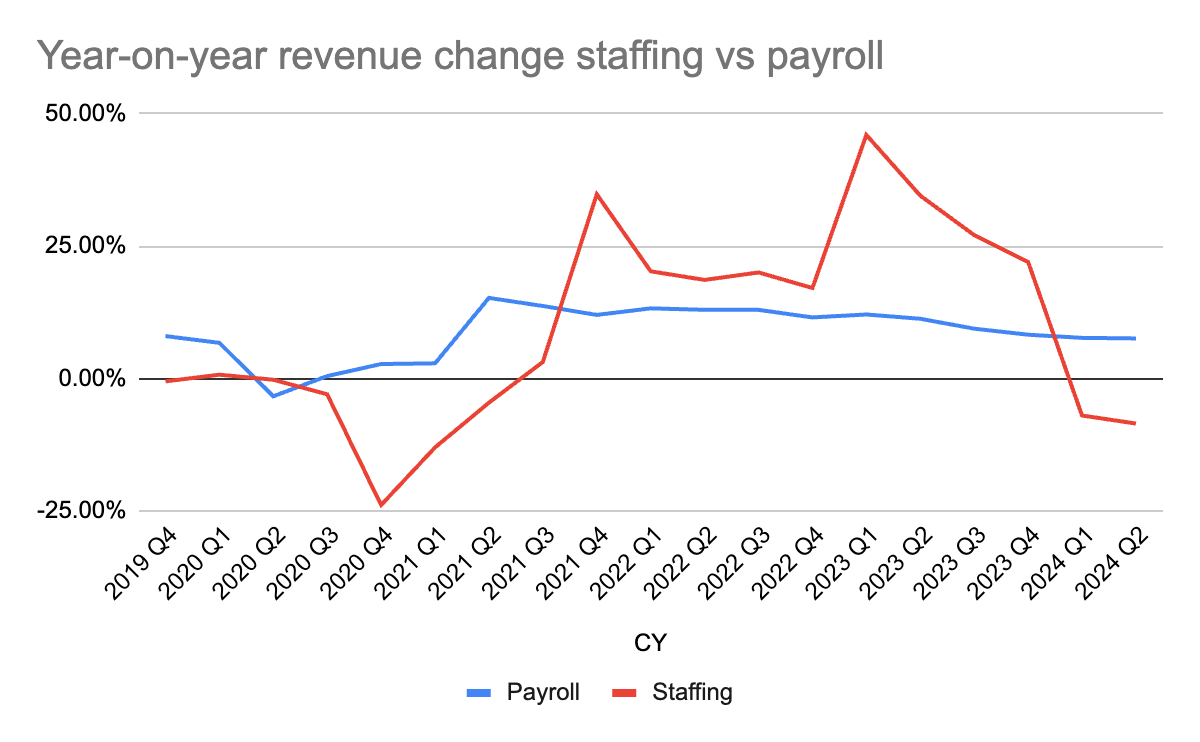

Payroll and HR Tech businesses have revenue tied to the payroll numbers, while businesses in staffing and hiring are tied to the rate of change of hiring. What we see is payroll companies continue to grow in revenue (albeit at declining rates) while staffing and placement related businesses see revenue declines. There is some evidence of pricing power in a few businesses.

LinkedIn, Upwork, and Fiverr are growing revenue while their actual usage is decreasing. Fiverr and Upwork continue to see ever so slight GSV declines, but this is offset by expansion in their take rates.

The continued decline in the US labor market, softness in Northern Europe, and flashing warning signals in Japan make these updates less exciting.

Revenue charts show the labor market changes

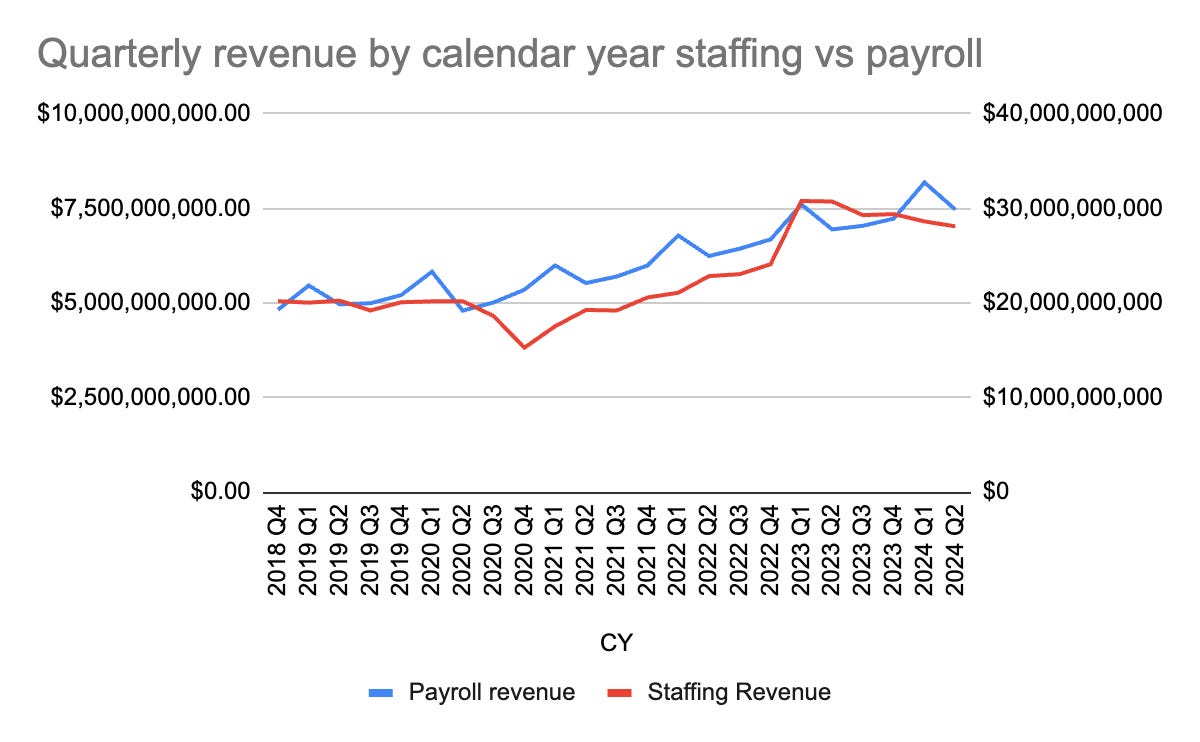

Looking at the revenue of publicly traded payroll companies and staffing companies over time, it’s easy to see the impacts of macro forces on the labor market. Covid spurred huge demand, interest rate changes shocked the job market.

The above chart is the sum of publicly traded payroll and staffing companies. The left axis shows payroll revenue while the right axis shows staffing. The consistent “bumps” in payroll occur during the Q1 period when payroll companies book the most new clients. Also note, for the attentive this is the top line sum of these companies revenue, I did not segment it out. So, for instance, ADP includes its PEO business while Manpower includes its outplacement and workforce development lines. Next update I’ll start to segment business units.

We can see the revenue acceleration in covid, with the publicly reported revenue doubling from pre-Covid to during covid (before the fed started raising rates).

Breaking out the changes year on year, the volatility of payroll is lower, although it too saw a meaningful increase in revenue thanks to covid.

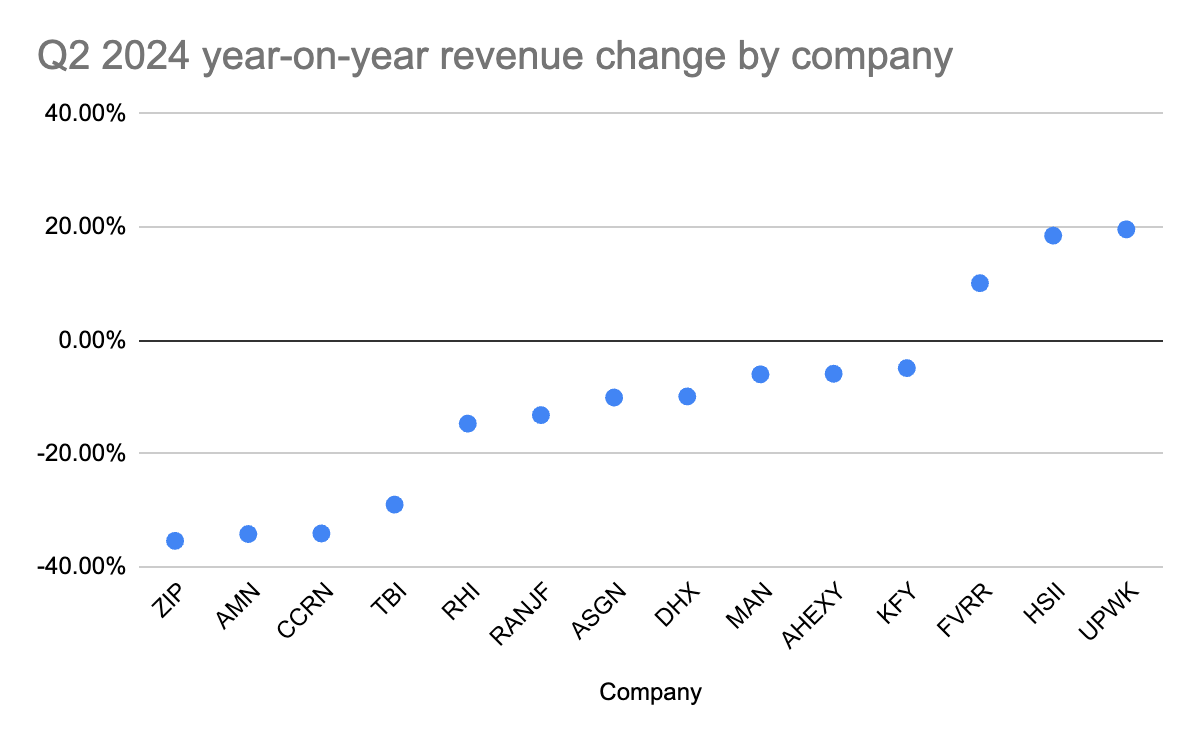

There’s a wide dispersion in revenue growth for companies that monetize around hiring

Breaking down hiring related businesses, there is actually quite a large bit of variation in performance.

A high level view of what drove revenue performance:

The bottom performers- SMB and temp healthcare staffing

Ziprecruiter - Zip serves small businesses and they’ve focused on moving from flat-rate pricing to performance-based pricing (higher volatility)

AMN and CCRN serve healthcare and temporary nurse staffing. Nurse hiring saw huge demand spikes for travel nurses and large wage increases. While nurses are still in demand, the federally subsidized salaries for travel nurses are not.

The muddling middle - diversified staffing and placement

We then start to get into more broadly diversified placement and staffing firms like Robert Half, Adecco, Randstad. These companies are just seeing macro forces play out globally, with weakness in the US, France, Germany, etc.

The best performers - freelance marketplaces with pricing power & HSII

Upwork and Fiverr are growing revenues by increasing take rates, while marketplace volumes are flat/declining.

HSII - Heidrick & Struggles is predominantly an executive search platform, but it also offers on demand executive talent and consulting services. It was on-demand and consulting that drove the revenue increases.

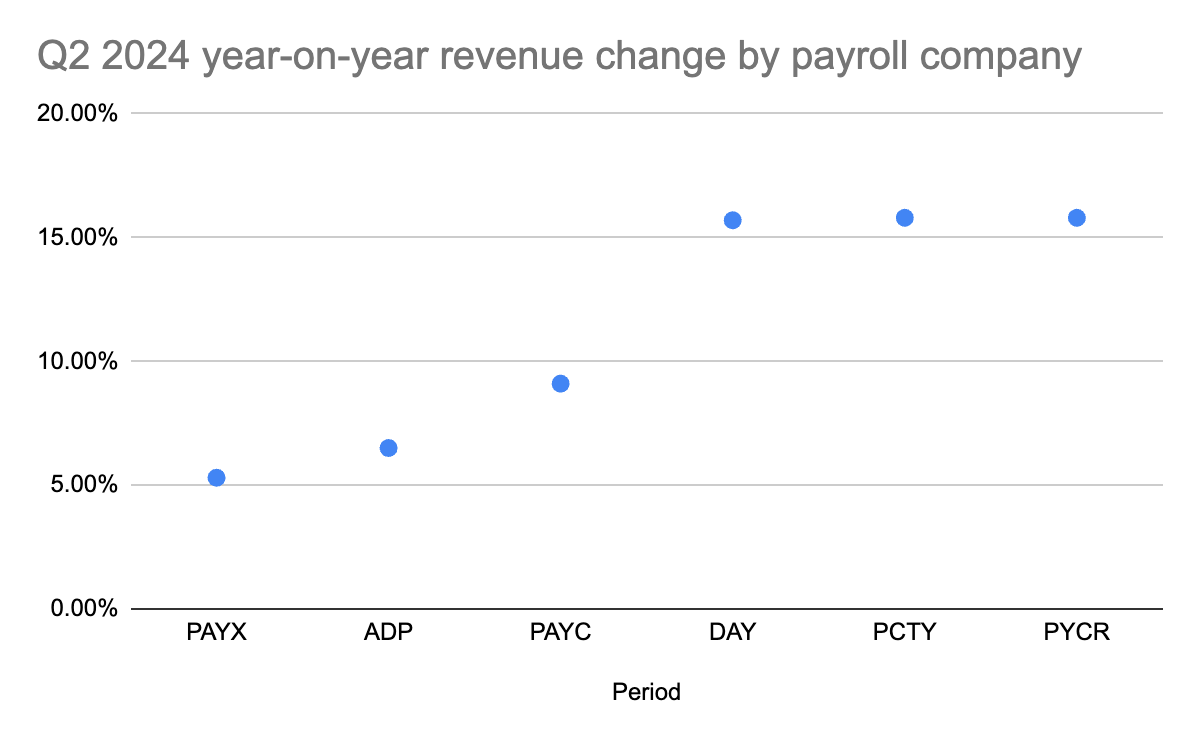

Payroll companies have tighter operating performance

Payroll revenue comparisons all show growth and more consistent performance.

Quick explanations of the minimal variance

Paychex (Payx) primarily serves SMB and that segment is struggling the most

ADP is just huge - the law of large numbers applies.

Paycom is still adjusting to its pricing and product change, Beti

The others have fairly strong growth. Note Paycor is still Q1 as it earnings come out on the 14th.

Healthcare soft but stabilizing

The healthcare market has seen sharp drops, particularly in travel nursing, but signs of stabilization are starting to emerge.

CCRN reported a 48% year-on-year decline in travel nursing, but CCRN’s CEO also had this to say:

After troughing at the end of the first quarter, travel demand has been steadily rising in the last couple of months and today, it is up more than 20% relative to the start of the second quarter.

This can be compared to other segments, like physician staffing (up 7% YoY) and Homecare staffing (up 12% YoY).

AMN, the largest healthcare staffing firm, saw similar patterns. Nurse and Alliened solutions revenue was down 36% year-on-year, led by lower volumes and rates in the travel nurse segment. However, signs of growth emerged, too. As AMN’s CEO, Cary Grace, laid out.

Demand as measured by open orders has been on upward trend since April. Total nurse and allied orders grew nearly 20% since the beginning of the second quarter, with the strongest growth in travel nurse.

Though this increase was less than past normal seasonality, it was much improved over last year. At the same time, we continue to see large clients reduce the utilization of contingent labor amid strong permanent hiring and reduced employee attrition. Labor market data show that permanent job growth for hospitals in the first half of 2024 was the strongest since 1982.

One of the defining issues in nursing has been attrition, so if it’s abating, that could make a large shift in the opportunity that a number of startups went after around the covid years. Something to watch.

Outside of the financial performance of these companies, there are a handful of product changes, particularly leveraging Gen AI, that are emerging. However, I’ll cover some of those developments next week.

Concluding thoughts

Lackluster macro drives lackluster earnings updates. Analyst questions all include some variation of, “are thinking turning around? when might they?” but management teams have no more insight than anyone else.