From Performance Marketer to Investor

In 2020, I faced a career-altering realization—AI was advancing rapidly, and Google was on track to automate my role as a performance marketer. This wasn’t just a minor disruption; ML & Gen AI were going to eat up targeting, creative generation, budget allocation, content marketing, and, eventually, marketing strategy. I had to make a choice: evolve or become obsolete. This realization set me on a path to transition from performance marketing to startup investing, but the journey wasn't straightforward.

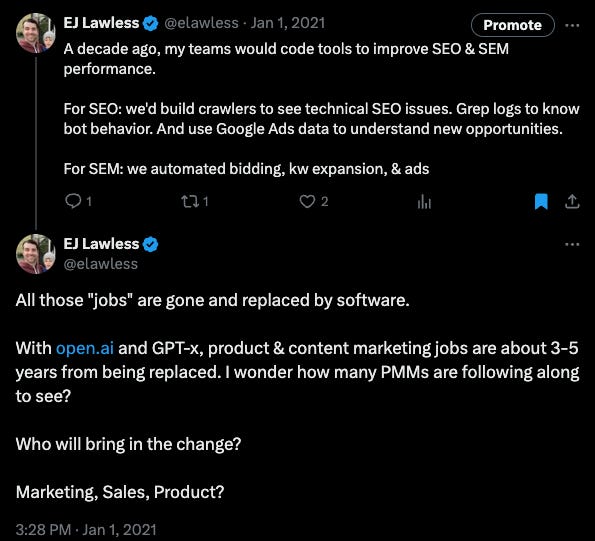

The Rise of Automation in Marketing

I joined Indeed in 2010 as the head of a small, three-person “online marketing” team. Back then, paid search management was relatively simple—we used basic formulas in spreadsheets to track and optimize campaigns. But as our budget grew, so did the complexity of our work. Over time, we moved toward automation, building out more sophisticated tools, and our team grew accordingly. We started hiring people with technical backgrounds in computer science and math, and by 2013, we had a fully automated bidding system that could handle much of the work we used to do manually.

By the time I left Indeed in 2013 to pursue my own startup ambitions, the paid search budget had grown over 200%, and the number of people managing it had increased by 400%. I saw initial signs —AI was starting to creep into marketing— but I didn't yet understand how fully it would transform the landscape.

My Return to Indeed: A New Perspective

I came back to Indeed in 2016, initially to oversee SEO. Over a few years, I took on the responsibility of leading all performance marketing. In the years since I had been away from paid search, the landscape had changed significantly. Google’s AI capabilities had evolved rapidly, and their automated tools for paid search were becoming more sophisticated. At Indeed, we had developed highly automated keyword management processes and relied heavily on exact match targeting. But even with those efforts, it became clear that Google’s AI could outperform us in areas like keyword matching and targeting.

Our early forays into Google’s automated targeting, particularly with Dynamic Search Ads, showed promise. Google’s AI could generate keyword combinations that we hadn’t considered and often knew more about the user’s likelihood to convert than we did. This was a turning point for me—AI wasn’t just a tool to help us; it was a competitor.

The Moment of Truth: Embracing AI in Paid Search

As AI continued to advance, I faced a critical decision in our paid search strategy. Our in house, algorithmic efforts, were losing ground to Google’s AI-powered bidding algorithms. Initially, we had tried to implement Google’s automated bidding solutions, but our cautious, risk-averse approach led to poor results. However, as I saw AI improving, I decided to fully embrace the trend.

We increased our data volume and committed to AI-driven strategies. The results were remarkable. AI-powered bidding could optimize campaigns far better than we could manually, and our efficiency skyrocketed. A team of one or two people could now manage a paid search budget ten times larger than what it had been just a few years earlier. AI matching and bidding had become so good that it rendered much of our manual work unnecessary.

While this was an exciting breakthrough, it also posed an existential question about my career. If AI could handle all of this so effectively, what would be left for me to do? The writing was on the wall—AI was going to automate most of my career, and I needed to find a new path forward.

Why I Chose Investing

Faced with the realization that AI would soon render my role obsolete, I began to explore new career options. I saw three possible paths:

Accept a ceiling in my current role as AI took over more responsibilities.

Start an agency, leveraging my deep experience in performance marketing.

Transition into startup investing.

The third option intrigued me the most. I had seen people like Andrew Chen, Mike Duboe, and Eric Seufert —former performance marketers with strong analytical skills—successfully transition into investing. It made sense: deploying marketing budgets to maximize returns shared a lot in common with deploying capital into startups.

I realized I didn’t need to follow the traditional path into venture capital, which typically involves investment banking or getting an MBA from GSB or HBS. I already had experience founding startups, raising money, and working in the startup ecosystem. I decided to invest as much time and capital into angel investing as I would in getting an MBA. Over the next few years, I would build my investment portfolio and learn by doing.

Why AI and Automation Became My Focus

One of the key challenges I faced at Indeed was matching supply and demand in the job market. It’s a complex, constantly shifting problem. Despite the best efforts of my team, the challenges in connecting millions of job seekers with employers became clear to me over time. We used AI to improve search, targeting, and keyword matching in marketing, but I saw the potential for technology to solve much bigger challenges.

This experience made me realize that AI and robotics could reshape industries—far beyond just marketing. AI’s ability to predict patterns, automate complex processes, and improve efficiency could be applied to sectors like healthcare, logistics, and manufacturing. Robotics, as an extension of AI, seemed the next logical step: moving from software-driven optimization to the physical automation of tasks that traditionally required human labor.

Having worked with AI for years, I understood its power to automate repetitive tasks and scale processes. This understanding shaped my investment thesis. I wanted to back startups using AI and robotics to solve complex problems across industries, just as AI had revolutionized digital marketing. My experience gave me the conviction that AI and robotics were the future of both automation and investment opportunities.

Building the Foundation for Angel Investing

With my focus on AI and robotics solidified, I knew that sourcing and selecting deals would be critical. Adding operational value would be difficult with a full-time job and two young kids, so I concentrated on building a strong foundation for investing. To achieve this, I focused on three main strategies:

Starting a Syndicate: In 2021, syndicates and solo GPs were on the rise, and I saw an opportunity to leverage my network. Many former employees from companies like Google, Uber, and DoorDash were investing in startups, often backing founders from their former workplaces. At Indeed, there were plenty of entrepreneurial people, but the company itself wasn’t participating in this trend. I saw a gap and formed a syndicate, bringing together former Indeed colleagues to invest in ex-Indeedians and other startups that aligned with our experience.

Launching a Podcast: To increase my deal flow and improve my network, I launched the HR Tech GTM podcast. This podcast allowed me to connect with leaders in the HR tech and future-of-work spaces, exploring go-to-market strategies and emerging trends in HR technology. I interviewed founders, operators, and investors, gaining firsthand insights into the rapidly evolving world of work technology. These conversations not only provided valuable learning experiences but also brought me direct investment opportunities. Through in-depth discussions with experts like Brad Bogolea from Simbe Robotics and Caroline Yeager from Vitalize, I identified promising startups that matched my investment thesis. The podcast became an invaluable tool for building my network, improving my industry knowledge, and expanding my deal pipeline.

Learning from Others: I made it a priority to learn from more experienced investors, especially when it came to improving my selection process. I reviewed past deals, learned what made certain investments successful, and applied those lessons to my own decisions.

Starting a Syndicate

2021 and 2022 were the years of solo GPs and syndicates. I saw many ex-employees from major tech companies like Google and Uber investing in startups, particularly in ventures founded by former colleagues. At Indeed, we had a growing number of entrepreneurial alumni, but there wasn’t a formal structure for investing in their startups. Recognizing this opportunity, I gathered a group of former colleagues and started a syndicate, Full Outer Join (a reference to unicode, conference room names from an early office).

Our syndicate was focused on investing in ex-Indeedians but also looked at other companies that might be relevant to our network. Building the syndicate’s LP base took some effort. We reached out to people within our network who were both willing and able to invest. This collective approach allowed us to pool resources, learn from each other, and increase the size of our investments.

End of part I

In this first phase of my journey, I went from realizing that AI would soon automate my job to taking my first steps into startup investing. Forming a syndicate, launching the podcast, and building my investment network were crucial parts of the transition. In the next part, I’ll dive deeper into how I made the leap from performance marketing to full-time venture investing, the challenges I faced along the way, and the strategies I used to overcome them. Stay tuned!

I am interested in a similar journey but starting from a different path: switching from marketing to building things with my own hand: houses, construction materials, robotics - and then in 20 years end up as an investor