Judging by Upwork and Fiverr’s earnings calls, they want you to know one thing — Gen AI is good for their business. This might be a surprise. Perhaps you thought the ability to ask for a logo or landing page copy in natural language would commoditize their business. In some cases, you’d be right.

But, ChatGPT is a General Purpose Technology. GPT adoption is following the trend where the commodification of low-skill jobs spurs demand for higher-skill jobs. In particular, Upwork reported a 50% year-on-year growth in AI & machine learning while Fiverr saw a 95% increase in GMV for AI services. Fortunately, for both businesses, AI categories have higher average order value than the services they are replacing.

Looking at the top-line, marketplace numbers, it is likely that Gen AI is impacting the lower value categories. And, digging into marketing and product tactics, it’s possible to see what’s driving some of the Generative AI customer acquisition strategies.

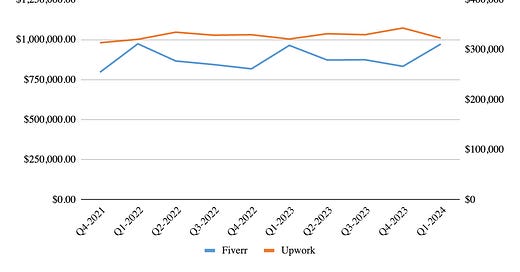

Marketplace Merchandise Value is Flat

While revenue for both businesses continues to grow, thanks to increases in take rates, gross volume in both marketplaces has flatlined.

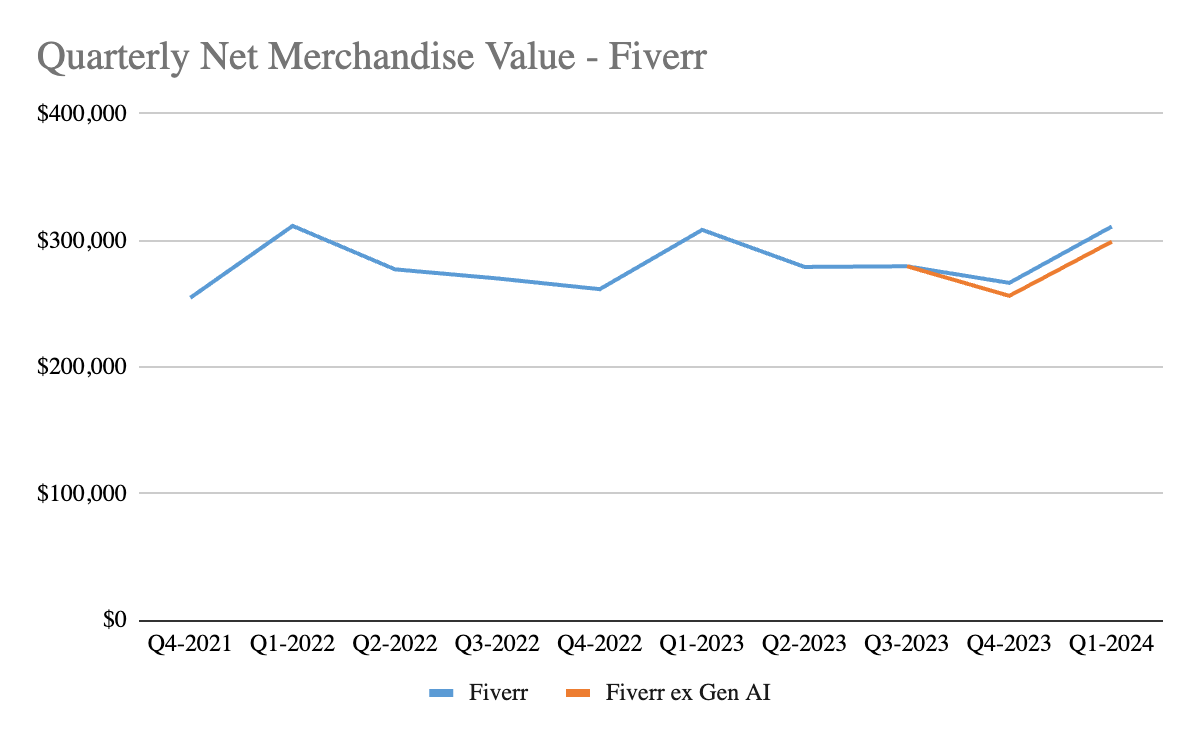

Without AI, Fiverr’s marketplace value might be shrinking

Digging more specifically into Fiverr, and backing out the contribution of Gen AI to GMV shows, GMV declining slightly — at least for Fiverr (Upwork doesn’t provide enough insights to know). In Q4 2023 prepared remarks Fiverr wrote, “AI drove a +4% uplift in GMV. Our investments in AI and highly skilled categories led to a 4% net positive impact on GMV in 2023.” Backing this out, Net Merchandise Value would have been down year-on-year for Q4 2023 — and likely Q1 2024.

Upwork’s comments on Generative AI are less specific. In the most recent earnings release Upwork said that the AI & Machine Learning category GSV grew 50% year-over-year, representing the fastest-growing category on Upwork.

Based on some of Upwork’s approach, it’s possible Upwork isn’t disclosing an impact because it’s minimal, at best.

Based on data from Similarweb keyword research and then additional transformations and analysis with Python Pandas, it’s possible to get a better understanding of each company’s acquisition strategy.

Fiverr and Upwork are pursuing Gen AI in two different ways

Fiverr and Upwork have approached Generative AI in two different ways for the past year. Fiverr integrated Gen AI into the product earlier and is focused on using marketing to drive revenue around Generative AI.

Upwork is using Gen AI as an accelerant around its core, human services offering and is focused on generating awareness of Generative AI. Awareness strategies take longer to convert to revenue.

SEO plays a key part in both Fiverr’s and Upwork’s acquisition efforts

Both Fiverr and Upwork are using SEO to grow generative AI traffic. However, Upwork has leaned into top-of-funnel, awareness terms. This is shown by Upwork’s high share of AI-related SEO traffic going to general content (‘resources’) pages.

Upwork is more focused on awareness strategies while Fiverr is focused on conversion

Looking at AI-related traffic through an Awareness, Interest, Action framework, it’s clear Upwork is targeting higher-level, longer to convert ‘awareness’. This is reflected in the types of pages driving traffic for Upwork. Whereas Fiverr’s is winning on lower funnel, revenue converting terms.

Breaking down Generative AI traffic by ‘sub-folder’; the high-level resources stands out for Upwork. Fiverr is driving traffic on ‘resources’, but gigs, categories, and their ‘logo maker’ page are driving a higher percentage of traffic.

Fiverr’s product-driven SEO vs Upwork’s editorial SEO

Fiverr is taking a product driven approach to SEO, doing the work to create category and services listing pages with ‘gigs’ and ‘categories’. This takes time and effort from engineering and product teams, but creates more scalable, higher converting pages.

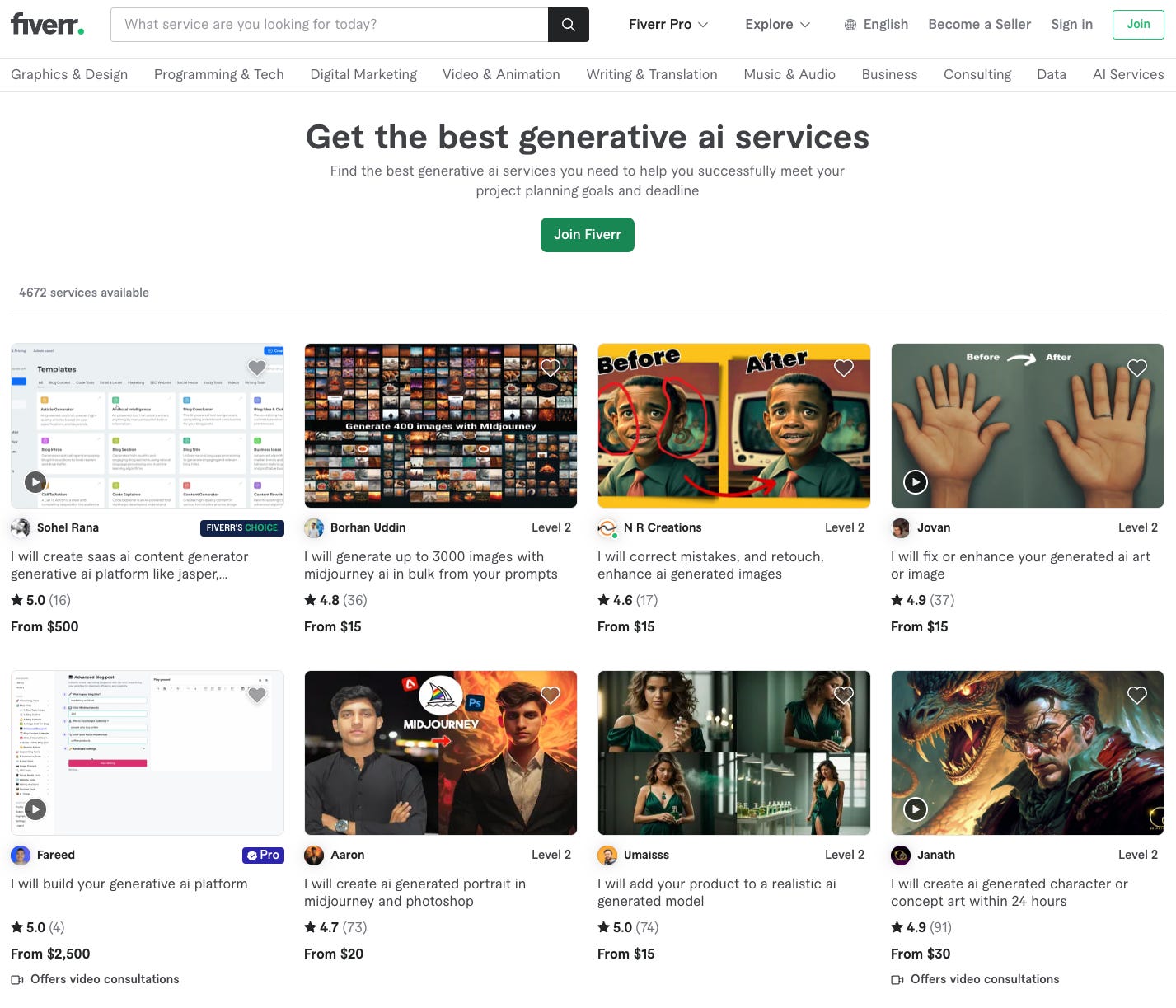

A Fiverr Gigs page is their SKU listings page that shows a number of different Gen AI skus. These types of pages have calls-to-action that guide users and convert at higher levels.

Whereas Upwork’s resource type pages are high level explaining a concept like Generative AI. Generally, these pages have very low conversion rates.

Fiverr’s product approach to Gen AI

Fiverr’s SKU-based approach to services let’s it put AI-products in its offering. Buyers are coming to get specific tasks completed, like logo generation. Writing text to get an image is how Fiverr, and some Gen AI, services operate.

Fiverr can offer AI services with a human in the loop. In fact, Fiverr has had AI-product service offerings for years with its ‘Logo Maker’ service. This makes the transition to Generative AI skus easier from a business model perspective.

Upwork is focused on revenue generation and reducing marketplace friction

Upwork is focused on new revenue streams, including Upwork’s advertising product and Freelancer Plus subscription offering. Both get covered in the latest earnings call. On the earnings call, Upwork highlighted having 100k active Freelancer Plus subscriptions in the quarter. At $20/month, that’s a nice revenue stream.

Upwork is focused on AI, too. Upwork launched ‘Uma’, a ‘mindful’ AI, that helps reduce friction in using Upwork. Per Upwork’s Q1 2024 earnings call, early testing shows a 7% lift in spending.

Fiverr and Upwork are both investing heavily in generative AI, but the impact to their businesses is still small. Although it is early days.

Fiverr Q1 2024 Earnings Update

Revenue: $93.5 million, up 6.3% year-over-year, at the top end of guidance.

AI: Significant growth in AI service categories, with GMV from AI services up 95% year-over-yea

Upwork Q1 2024 Earnings Update

Overall Company Performance:

Revenue: $190.9 million, a 19% year-over-year increase.

Upwork raised its full-year 2024 revenue on Q1 performance

Product Highlights:

Release of Uma AI

Upwork Freelancer Plus subscription growth

VMS expansion