Robots can make for great investments

Close to $2B in revenue, 55% year-on-year growth, profitable. $8B in revenue, growing 17% YoY, and 70% gross margins. These are not software companies, but two fast growing, large, robotics companies. Symbotic and Intuitive Surgical, respectively.

Each of these companies exists in categories with competitors, but both of them are running away with the current market (as measured by actually vended revenue, not TAM).

Focus on experience, not labor savings

Both of these companies focus on the providing a better experience for the end user, not just a lower cost or labor replacement. For Intuitive Surgical, a growing body of research shows better surgical outcomes and faster recovery times. Symbotic, enables faster shipping times and better handling of returns. This helps customers like Walmart keep pace with Amazon.

Solutions that sell automation can focus on cost savings and efficiency or on differentiation and improved experience. A hospital with a Da Vinci robot can advertise its surgical center, versus another hospital, driving more customers. Amazon used its prime turn around time to do the same, and now Walmart is able to catch up.

The perils of focusing on cost savings

Automation that focuses on cost savings, often via labor replacement, run into two big issues.

1. There can always be a cheaper solution

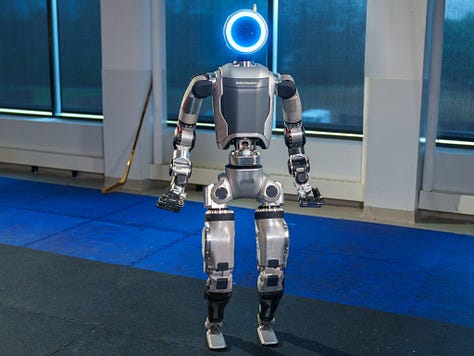

The cheaper solution appears in a number of places, not limited to AI and automation. But humanoid robotics show a price point progression from Agility Digit at a rumor $250k, Boston Dynamics Atlas for $75, and then Unitree G1 for an alleged $16k. Undoubtedly, someone will eventually announce a sub $10k robot.

When someone chooses a solution on price, they will often to continue to choose on price. Expect net revenue retention to be worse driven by difficulty expanding contracts and higher general churn rates.

2. Most people do not want to cause to the mass layoffs of their peers.

Focusing on labor savings and efficiency can led to customers not fully implementing, or using, a solution, for fear of job losses.

Cost savings and an agentic future

As we approach an Agentic future (and not long after, an embodied future), people will be hesitant to adopt the full capabilities of the agents — if it means a reduction in workforce. Fully adopting an effective, automated (or agentic) solution could mean hundreds (or thousands) of workers are no longer needed. Most employees will resist this future, fearing for their own jobs and the jobs of friends and colleagues.

If instead of focusing on cost savings, the value proposition of the automation solutions talks about new capabilities, it can lead to hiring changes and new positions. For example, after Kroger opens up an Ocado Fulfillment Center, it might need to hire delivery drivers, fleet repair technicians, and fleet managers. The automation solution enables a new capability, and a better experience.

The focus on capability and new experience shows up in the latest earnings calls for Symbotic and Intuitive Surgical.

Earnings calls highlight capabilities over price savings

Symbotic expanded internationally, into Mexico. A place considered a lower cost of labor location, and less open to automation. Read the following earnings call Q&A to get a sense.

Greg Palm (Analyst from Craig-Hallum)

…what struck me as maybe most surprising as your first international win was in Mexico a lower cost sort of labor wage region, which I guess kind of begs the question of what does that mean for your broader TAM, thinking broadly speaking, Asia, for instance, this maybe increase the TAM potential in terms of opportunities of deploying Symbotic in regions maybe you thought weren't maybe at an appetite you saw previously?

Carol Hibbard (Symbotic CFO)

Yeah. Thanks for the question, Greg. Yeah. We're -- that's why we're really excited about this particular one. It does emphasize the ROI even in those lower cost geographies. And so Rick alluded to it on an earlier question, it emphasizes sites in lower cost geographies. They are also valuing the inventory improvement, the transportation costs, and just the overall quality of what we are able to deploy. So we do think that opens up the geography. And really gives another proof point that the system provides the ROA even in a low-cost geography. [emphasis added]

Rick Cohen (Symbotic CEO)

In some ways, what is so interesting and reassuring for us is, in some ways, the U.S. is the hardest market because it really has one of the best supply chains in the world. But when you get to some other markets where the supply chains really are not very sophisticated there's lots of opportunity to take inventory out, probably in labor in terms of inefficient labor and transportation in terms of getting all the right products in the right place at the right time. So we're very excited, and we

Intuitive Surgical highlighted its own ROI, albeit with a lot more statistics involved:

Earlier this year, Dr. Maegawa from the Department of surgery at Emory University in Atlanta, Georgia, published in the journal surgery, a study comparing robotic and laparoscopic cholecystectomy procedures for benign indications performed in 2022. Using the American College of Surgeons National Surgical Quality Improvement Program Database, over 59,000 patients were included in this study with over 53,000 in the laparoscopic arm and approximately 5,500 in the robotic assisted arm.

Through a multivariable logistic regression analysis, which controlled for confounding factors, patients undergoing a robotic-assisted cholecystectomy had an 18% lower chance of experiencing a serious complication, as well as a 56% lower chance of a conversion to open and 24% lower risk of requiring hospitalization for more than 24 hours. The authors also looked at elective cholecystectomies only and reported a 46% lower chance of conversion to open, 59% lower chance of re-operation, and 30% lower odds of a hospitalization over 24 hours associated with robotic-assisted cholecystectomies.

The authors concluded “using a large and recent national surgical database, the study showed that overall robotic cholecystectomies were independently associated with a lower risk of serious complications, lower rate of conversions to open, and lower risk of hospitalization greater than 24 hours when compared to laparoscopy. These findings suggest that the adoption of new technologies might enhance the safety of minimally invasive surgery in selected cases.”

The benefits of systems accrue to users.

Two ‘future-of-work’ highlights from earnings

Intuitive Surgical and Symbotic highlight, at least, two other interest trends that will affect the future of work. Teleoperations and the role of simulation in on the job training.

Symbotic’s use of vision in its robots enables teleoperations.

Among other features, vision gives our customers the ability to perform tele ops which enables remote bot control for enhanced productivity. We have now successfully demonstrated this capability at multiple sites and view it as a key differentiate.

Intuitive Surgical leverages VR and training simulators for training purposes.

In our digital efforts, nearly 3,000 DaVinci virtual reality simulators are in the installed base, and surgeons complete approximately 15,000 hours of training on simulators per quarter.

Intuitive Surgical Performance Highlights

Strong Financial Performance: Q3 2024 Reenue of $2.04 billion, up 17% year-on-year. GAAP net income of $565 million, compared to $416 million in the same quarter, 2023.

Successful Initiatives: The launch of Da Vinci 5 and its adoption across various specialties contributed positively. The Ion platform showed strong growth, particularly in the U.S.

Market Conditions: Mixed market conditions in Asia, with strong growth in Japan, Germany, France, and the U.K., but challenges in China and Europe due to budget pressures.

Product Performance: Da Vinci 5 and Ion platforms are performing well, with Da Vinci 5 showing early efficiency gains and Ion achieving high diagnostic yields.

Macro and Secular Trends: Increasing adoption of robotic-assisted surgeries globally, with reimbursement coverage expanding in multiple countries.

Symbotic Performance Highlights

Overall Company Performance

Revenue and Growth Metrics: Symbotic Inc. reported Q4 2024 revenue of $576.77 million, up from $392 in the previous quarter. Full-year revenue reached $1.8 billion, reflecting a 55% growth.

Margin Trends: Gross margin rebounded to 19.6%, returning to historical levels after a dip in Q3 due to elongated construction schedules.

Key Business Metrics: The company achieved its first quarter of net income as a public company, indicating improved financial health.

The future-of-work is moving from automation to AI, from AI to agents, from agents to robots. Different parts of this journey are happening at different speeds. By looking across the spectrum of innovation, we can find applicable lessons.